- Article - Jul 17, 2023

Personal lending

Consumers are demanding more choice and convenience from their lending providers. Our cloud-native lending engine and composable approach powers the flexible lending solutions needed to delight customers and put you ahead of the competition.

Make consumer lending personal

Innovate. Configure. Integrate

Product innovation

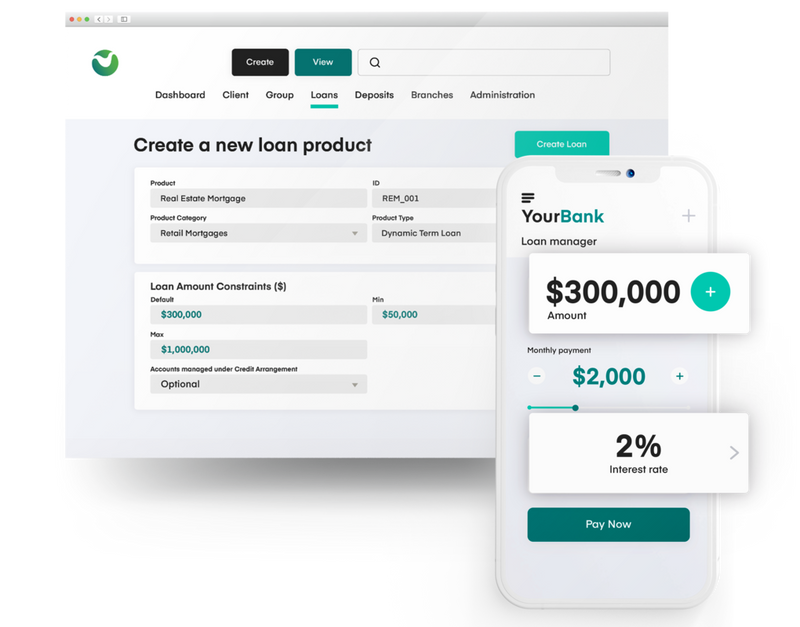

Our composable approach means you can access the tools needed to customise and launch fully configurable solutions using plug-and-play features tailored to the unique needs of your customers.

Flexible configuration

Build and modify personal lending products using modular components that can be assembled and reassembled as needed. Develop your clients’ interface with a detailed view of all loan obligations.

Integrate technologies

Our extensive APIs and open architecture enable seamless integrations with best-of-breed software providers, allowing you to deliver fit for purpose solutions with a faster time to market.

Features you want, when you need them

Innovate with pre-built product configurations

Mambu’s cloud-native lending engine gives you the features and functionality to use as-is or to configure to your specific requirements.

Banking on success

Customer stories

Seamless integration with world-class partners

Access our marketplace to integrate with best-for-purpose modern technology vendors to bring hyper personalised consumer lending products to light faster than ever before.

Recommended reading