BancoEstado

BancoEstado is Chile’s only state-owned bank, and it serves 13M customers.

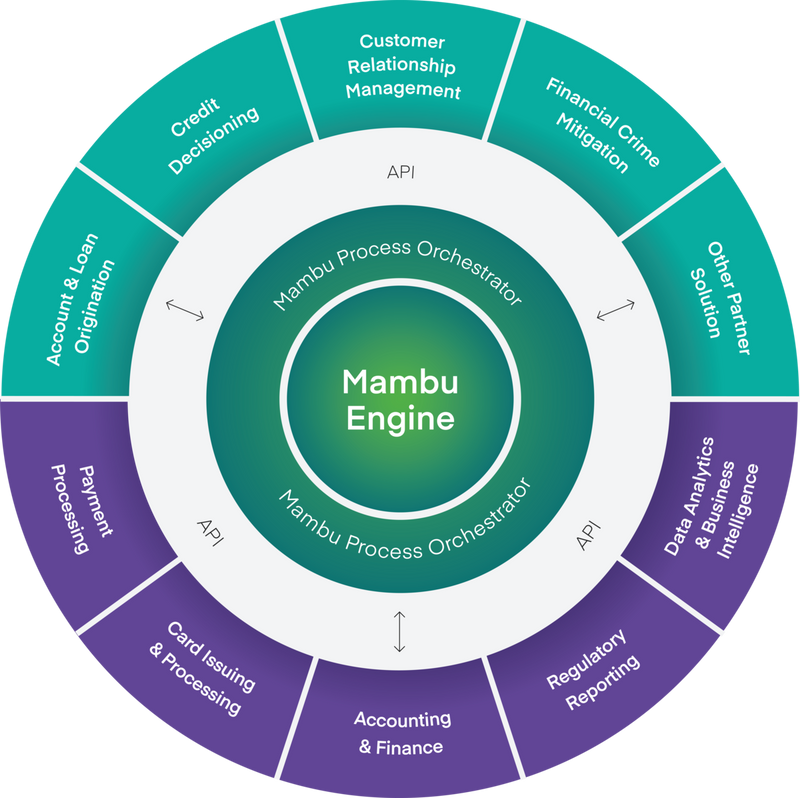

More than 75% of the world’s population has a financial account to deposit and save money, pay bills, connect a debit card, and receive funds. Mambu gives you a dynamic deposit engine and a connected ecosystem of third-party vendors that enable financial and non-financial institutions to build a variety of deposit-based offerings to reach this vast market.

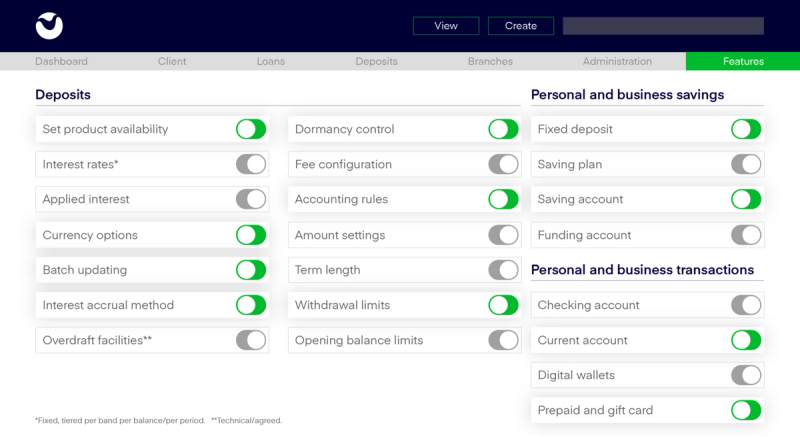

Our feature-rich and highly flexible cloud-native deposit engine enables financial and non-financial institutions to launch products fast. Create thousands of deposit products via low-code/no-code APIs. No cumbersome resources or processes needed.

Get in touch

Expand to new markets through scalable, low-code/no-code product configurations. Iterate and test with in-house resources and publicly available APIs to reduce development costs and connect your entire deposit and transactional ecosystem.

Daily transactional banking accounts for personal use with debit card/ overdraft support. Also known as current or chequing (checking) accounts.

Daily transactional banking accounts for business use with debit card/overdraft support. Also known as current or chequing (checking) accounts.

Limited current account functionality for digital wallet or gift card support.

Savings accounts for personal use with interest bearing capabilities.

Savings accounts for business use with interest bearing capabilities.

Launch new deposit products faster in a matter of days vs. months or even years compared to legacy core technology providers.

Proactively and continuously improve your products and services.

Reduce development costs and free up technical resources.

Create, upgrade, enhance or migrate deposit and transactional offerings of all types.

Cloud-native SaaS model, pay as you grow.

Multi-cloud approach - choose one of the three major cloud providers.

The only way to build a state-of-the-art bank is to find the best technology partner. One that can evolve at the speed today’s times demand while remaining simple and easy to use.

Simplify the handling of savings plans and maturity terms, providing full support for both positive and negative interest rate calculations, fixed, indexed and tiered banding, tax withholding or enforcing maximum account balance definitions.

Streamline the handling of arranged and technical overdrafts, provide full interest rate calculation support, levy additional overdraft fees and configure maximum overdraft limits in whichever way you need.

Mambu integrates with a broad range of connectors and software solutions that are needed to launch different types of stored value payment Instruments. Our composable approach gives businesses the freedom to take the deposit engine elements they need and integrate with preferred providers.

Multiple custom reporting and dashboard options to ensure that all key operational and performance metrics can be measured and tracked.

Put your personal savings and business deposit services and stored value, daily and business banking accounts ahead of the competition. Are you ready to make change to your biggest asset and eliminate reliance on restrictive old-fashioned core banking systems?

Expand to new markets through scalable, low-code/no-code product configuration. Iterate and test with in-house resources and publicly available APIs to reduce development costs.

Connect with best-in-class technology vendors to enable seamless, fully automated digital account opening processes and additional services, so you can onboard and approve new accounts.

We were in the cloud before it was cool. Optimise multi-cloud approaches with a choice of major cloud providers.

BancoEstado is Chile’s only state-owned bank, and it serves 13M customers.

TymeBank is the first bank in South Africa to receive a full banking license in almost 20 years.

Bank Islam is not only Shariah-compliant, but is also designed around the customer.

The first pan-European mobile-only bank serving millions of customers worldwide.