The first pan-European mobile-only bank powered by Mambu

From small start-up to banking powerhouse, N26 achieved rapid expansion with Mambu’s cloud-native banking platform becoming Germany's highest valued fintech.

- months to migrate

- countries in Europe

- million revenue relevant customers

N26

About the customer

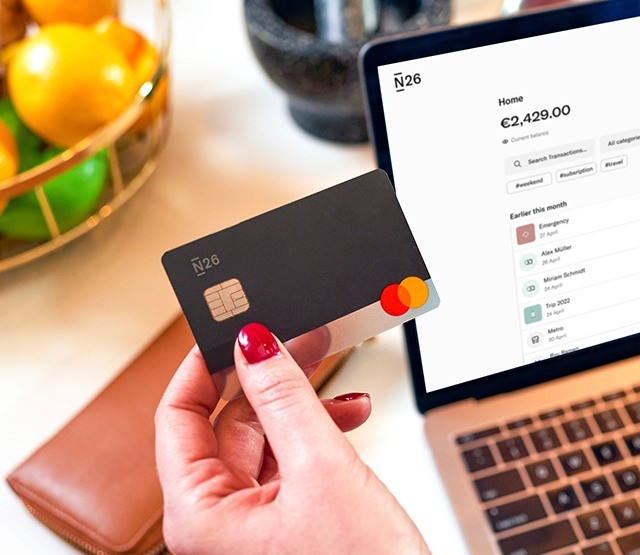

N26 was founded in 2013 in Berlin with the vision of creating a mobile-first banking experience that customers love. By 2015, it launched its first current account in Germany and quickly gained traction with its digital-first approach. In 2016, N26 secured its own banking license, becoming one of Europe’s first fully-licensed mobile banks.

Today, the bank’s seamless, app-based platform allows users to open accounts, manage finances, and access a range of innovative features—all tailored for the digital era.

- Now available in 24 European markets.

- Germany’s highest-valued fintech.

- Expanded product portfolio making it possible to save, spend and invest with N26, all in a few taps.

The challenge

Future-proof technology that scales seamlessly

N26’s initial setup relied on a partner-provided banking backend. While it enabled a quick launch, it limited the neobank's ability to scale, launch new products, and enter new markets. One of N26’s first steps to achieve its future aims was to become a licensed bank in its own right rather than rely on the license of its partner.

Building on this, N26 also made the decision to transition to a cloud-native banking platform. It needed a flexible, scalable, and cost-effective core banking solution.

The solution

A composable cloud-native core

Mambu’s composable banking platform became the backbone of N26’s operations in early 2016. Hosted on Amazon Web Services (AWS), the solution was tailored to N26’s needs, including:

- A customer sub-ledger system for managing transactions and balances.

- Overdraft capabilities seamlessly integrated into the platform.

- A foundation built for rapid product innovation and geographic expansion.

The result

The European blueprint for success

N26 built and launched on a new platform in 4 months. The launch was quick, cost-effective, and instrumental in helping N26 achieve its strategic goals.

Since the migration, N26 has scaled its operations significantly, driving strong customer growth while processing tens of millions of transactions each month. This performance demonstrates the robustness and scalability of the Mambu platform.

The new composable architecture also enabled geographic expansion, with N26 now operating across 24 European countries.

“Mambu’s ease of integration, flexibility and time to market has helped us give our customers an unrivalled, technology-driven mobile banking experience.”

- Gino Cordt, CTO, N26

Download the full case study

Download the full case study to uncover key insights from leading research firm Omdia including:

- The Mambu and N26 Journey

- Expert recommendations for the retail banking industry

- Lessons learned to drive change and growth