Incumbents are disrupting finance faster than ever. McKinsey estimates that 75% of quoted companies on the S&P500 will disappear by 2027, and at the same time, Bain & Company identifies that 90% of major growth success stories come from organisations continuously innovating and pushing the boundaries of their core business. Customer centricity, new business models, and innovation are must-haves rather than differentiators. So while incumbents are transforming themselves, what are the challenges they face against new entrants like fintechs and neobanks?

Transforming the core business is a survival must, and incumbents are increasingly building new value propositions or speedboats that can capture additional synergies and open new strategic avenues such as business diversification, new revenue streams, keep the pace with market and customer change, or build more agile, innovative, and efficient operating models.

Moreover, speedboats possess a competitive advantage against new entrants, displaying the agility and nimbleness of a fintech and the experience, scale, and skill of incumbents. Speedboats can be the best of breed solution for incumbents in the disruption era.

For example, ABN Amro identified that a radically different approach was required to satisfy the financing needs of entrepreneurs and small enterprises. To truly change how these clients were served, ABN Amro needed to re-think their customer experience and build a next-gen technology stack.

ABN Amro launched their speedboat New 10, specialised in transparent and close to real-time credit decisioning. New10 achieved a significant improvement in customer experience, reducing application times from weeks to minutes, and achieved NPS scores of 60%+, well above industry average. This enabled ABN Amro to increase their customer base, tap new revenue streams, and experiment with the latest technologies such as Mambu.

Building a new business is becoming an increasingly relevant top executive priority, even more so in financial services. Many incumbents have defined an ambitious vision including the launch of new speedboats, reimagining collaboration between new and core businesses. However, despite market tailwinds, only about 25% of the speedboats manage to acquire scale and are eventually considered successful. That’s why a winning value proposition is the first step in a successful launch for speedboats.

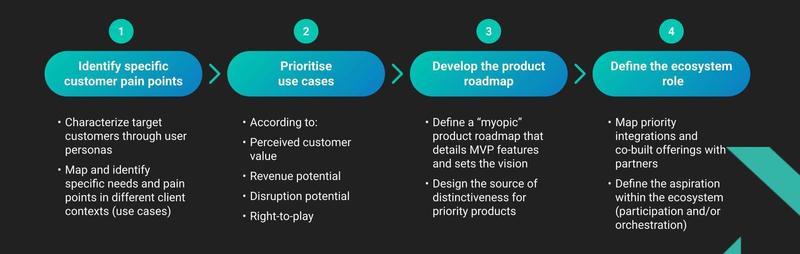

How have other players done it? We have identified a four-step approach to define a winning value proposition.

1. Identify customer pain points and unsolved needs

Successful speedboats start by identifying very specific, unsolved needs of a narrow customer segment and specialise in solving them. To do so, these organisations typically use quantitative (f.eg., surveys) and qualitative (f.eg., in-depth user interviews) research techniques to understand their potential targets better.

- Segmentation: these are customer archetypes that represent most of the target population in a market, including demographics, habits, needs, and pain points. Speedboats have additional sources of insight from years of market presence, research/intelligence, and transactional data history that can provide an edge when analysed with advanced analytics and business intelligence tools.

- Use cases: a backlog of unsolved needs and pain points is built. Each entry in this backlog is analysed and ranked by UX specialists and backed through extensive research on the targeted segments. Research may include walkthroughs, mystery shopper, and multiple in-depth contextual interviews with potential users.

After this process is run, there is a clear understanding of which are the most relevant pain points for each user context – these combinations of client contexts, pain points, and target segments are referred to as “use cases”.

2. Prioritise use cases based on business value

The use cases are prioritised according to the potential business value. There are four elements that are used to define use case business value and market attractiveness:

- Perceived customer value: level of customer dissatisfaction and frequency of occurrence.

- Size of the prize: volume of addressable customers, revenue, and profit pools (actuals and forecasts). Many speedboats are born with regional aspirations in the mid-term, hence applying a local and regional lens is advisable.

- Disruption markers: finding niches with low fintech competition, high end-user costs, and ability to better solve needs through technology.

- Right-to-play: this element is unique to speedboats and a key differentiator between fintechs and new entrants. It consists in identifying and assessing unique assets the incumbent (or the holding it belongs to) possesses relevant to the use case, and provide the speedboat with a competitive advantage. Speedboats use these assets, and their “uniqueness” is a barrier for new entrants or other incumbents who want to replicate the model.

3. Develop the product roadmap

Speedboats launch to market with a narrow product and service offering, improved with customer feedback, and only expanded when the initial product offering has a proven client traction. At this stage, speedboats usually develop:

- A “myopic” product roadmap: detailed planning of product features that are going to be launched during the first releases (eg., MVP) and a directional roadmap of potential following use cases priorities.

- Source of distinctiveness of your products: Market disruptors invest significant time studying how their customer journey and value proposition compares to existing offerings. These analyses range from fundamental aspects such as pricing or features to packaging and are updated regularly on a regional level. The combination of skills and assets between incumbents and speedboats as well as synergies in their operating model can be one of speedboats’ main source of distinctiveness against competitors.

4. Define your role within the ecosystem

Customers are demanding to have more of their needs solved within a single experience rather than in silos with different financial service suppliers. McKinsey estimates the integrated economy will represent a US $70 trillion opportunity by 2030 globally with 12 major ecosystems. To tap into this opportunity, speedboats must define:

- Integrations and co-built offerings with partners: speedboats may decide to integrate from the incumbent, build in-house, co-build with an external partner or integrate an offering. Speedboats typically leverage a preexistent network of potential partners to tap into through incumbents’ own partner network, B2B client base, or incubator arms.

- Aspiration within the ecosystem: set the vision of the participation or orchestration role the speedboat may have in its ecosystem – tracing a route for future partnerships, product development, and distribution channels.

Despite market momentum, there is still much untapped potential for new speedboats. Those that are successful at defining a winning value proposition will be closer to a successful launch and scale-up. However, a crystal-clear value proposition requires to be powered by next-gen technology to be brought into life.

At Mambu, we power 200+ disruptors globally, many of which are speedboats. Find out how Mambu and our Mambu Advisory team can help you build new speedboat propositions here.