Simply put, banks and financial institutions don’t have the time (or the funds) for long-haul transformations anymore. In a competitive market, it’s essential to move quickly on multiple fronts and differentiate yourself from the pack by working with strategic partners that are the very best at what they do.

By leveraging powerful digital banking solutions, banks can move beyond legacy technology, invest more in customer value and innovation, and accelerate time to market with significantly less risk. An ecosystem of best-in-breed partners already gives financial institutions 60-80% of what they need to be successful.

I recently sat down with Mambu’s VP of Partnerships & Advisory, Ben Snowman, to further explore the business value of Backbase and Mambu’s partnership, and we agreed on one thing straight away: customers demand more these days. They want a bank or credit union that makes it simple—and even enjoyable—to take control of their financial health.

Banks need to do more with less. In the current financial landscape, there’s no longer any appetite for five-year transformations that have no customer visibility. Banks need to act fast to re-architect banking around their customers, delivering seamless journeys that power the full customer lifecycle. But at the same time, they also need to take into account their own needs and limitations. Today, financial institutions don’t have the luxury of time, but with help from Backbase and Mambu, they can quickly make a big impact.

Let’s look at the business value of our partnership, which includes a faster time to market and significant risk reduction, both of which can be applied to different market segments.

Faster time to market

Many traditional banks are sitting on tech stacks that are 20–30 years old. This makes providing exceptional customer experiences impossible.

“While ten years ago they would have been forced to work with monolithic providers for several years, today, you’ve got the power of Backbase on the front end, combined with Mambu’s technology platform,” Ben said. “That’s two modern technology providers that meet customers’ needs and the needs of the banks. Together, we engender time to value, speed to market, and more. It’s a winning combination.”

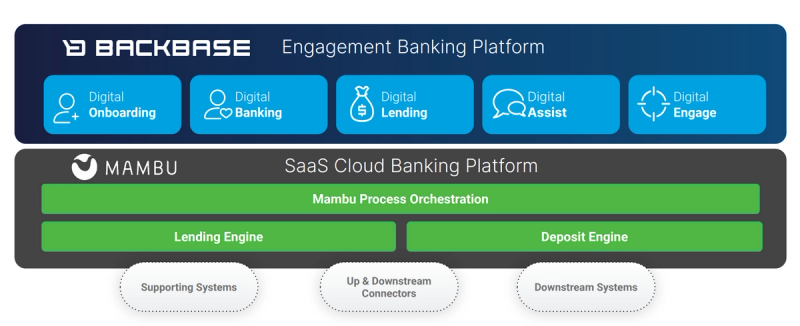

Backbase and Mambu created a comprehensive platform that directly integrates with core systems and allows banks and financial brands to innovate on top of it. No more waiting for a “big-bang” transformation. By working incrementally, banks can immediately fix the most critical issues and then move on.

Thanks to turn-key customer and employee apps, banks can reduce their time to launch new products by 80%, all while enjoying a 70% reduction in costs per user, when compared to traditional banks. Other out-of-the-box solutions cover all of their basic needs and give them a platform to innovate upon, getting them to market in a matter of months, rather than years. This saves them money and gradually allows them to build a truly unique banking experience.

Significant risk reduction

Most traditional financial institutions realise that they have to change, but the risk involved in digital transformation prevents them from acting. To solve their ongoing problems, from customer engagement to employee productivity, they continue to invest in inefficient point solutions and costly maintenance. But the days of high-risk digital transformations are over.

“When banks work with Mambu, they take a lot of risk out of the equation because we’re already successful in over 60 countries,” Ben said. “And when you add the Backbase element to that, you can make changes really, really quickly and de-risk things so it can be done again and again.”

Backbase and Mambu have been active in the field of digital transformation for years, and we’ve proven ourselves in our respective fields. Backbase works with over 150 financial institutions across the world, using an award-winning, category-leading platform to delight customers and empower employees. Mambu serves around 85 million end users a day for 230 global customers. That means that guesswork is not a part of our operations.

Application of different segments

And the best part? All of this is possible for every type of bank, from regional credit unions to large tier-one financial institutions. Together, Backbase and Mambu have created a comprehensive, composable, enterprise-grade solution that gets banks of all sizes to market fast, all while minimising risk across the board. In doing so, we’ve eliminated two of the biggest reasons why these banks have resisted digital transformation up to this point.

“Whether you’re a neobank, a tier-two, tier-three bank, or one of the world’s largest banks, you can solve slices really, really quickly with low-risk, fundamental changes in economics and please your customers in a relatively short space of time,” Ben said.

Our shared DNA

At the end of the day, Backbase and Mambu are partners because we have a lot in common. We’ve both been dominant players in our respective areas for years. But more importantly, we share a mission:

We help the industry grow and mature. That’s why we’re partnering together; we’re orchestrating the evolution of the industry.

Together, Backbase and Mambu have devoted an immense amount of time to making sure our combined products deliver as much business value as possible for our customers. But we also want to take an active role in the growth of the banking sector. That’s why we’ve dedicated ourselves to ongoing ecosystem orchestration and helping our clients get the very most out of their digital transformation – moving quickly and at the lowest possible amount of risk.