A global digital engineering company, Persistent is a strategic partner of Mambu offering industry and technical expertise along with vast experience with Mambu’s cloud banking platform. Through this partnership, customers are able to modernise their technology and operating models to respond to growing expectations from today’s banking consumers. With Mambu and Persistent, banks can rapidly build and launch new products while reducing operating costs and complexity.

Together, Mambu and Persistent facilitate the rapid deployment of cloud-era digital technology across lending, deposits and everyday accounts, among others. By combining Mambu’s cloud-native banking platform - an ecosystem of 70+ best of breed ISV partners - with Persistent’s expertise as a system integrator and developer of front end experiences, customers have access to a powerful and proven set of providers to help them on their digital journey.

As the world becomes more connected, an increasing number of banking customers are seeking a single digital wallet which allows them to hold and spend in different currencies in a seamless manner. These Multi-Currency accounts offer customers a range of valuable use cases.

Persistent has developed a solution with pre-built integrations into Mambu and the ISV ecosystem which enables institutions to launch a Multi-Currency Wallet, quickly, decisively and globally.

The first functionality to highlight is the consolidated total amount of multiple accounts in multiple currencies.

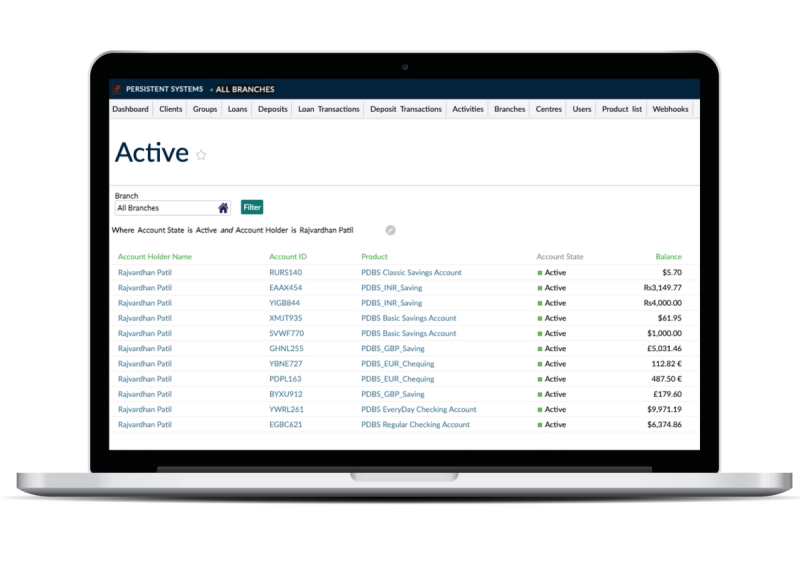

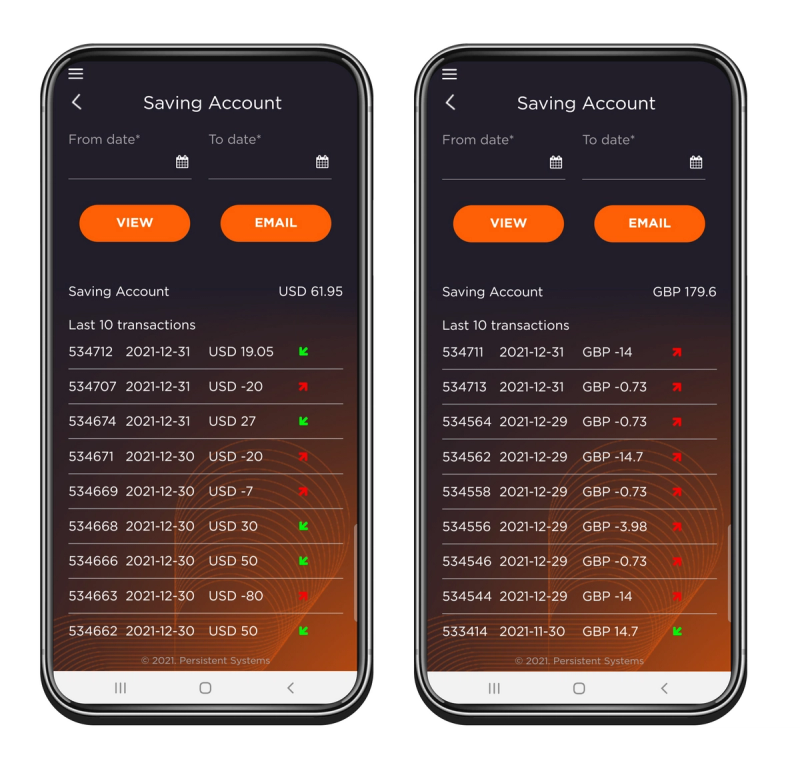

A single customer with multiple accounts in multiple currencies is visible in the Mambu back end. Each account displays the type, balance and currency amongst other details. In this example we see the user holds accounts in four currencies: USD, EUR, GBP and INR.

When the customer logs into their mobile banking app, the dashboard displays the total balance for each currency account. Under the ‘Account’ tile, the consolidated total of all accounts is shown ($29,517.63). Once selecting this tab, an overview of all account types is displayed, with the sum of each account displayed in US Dollars.

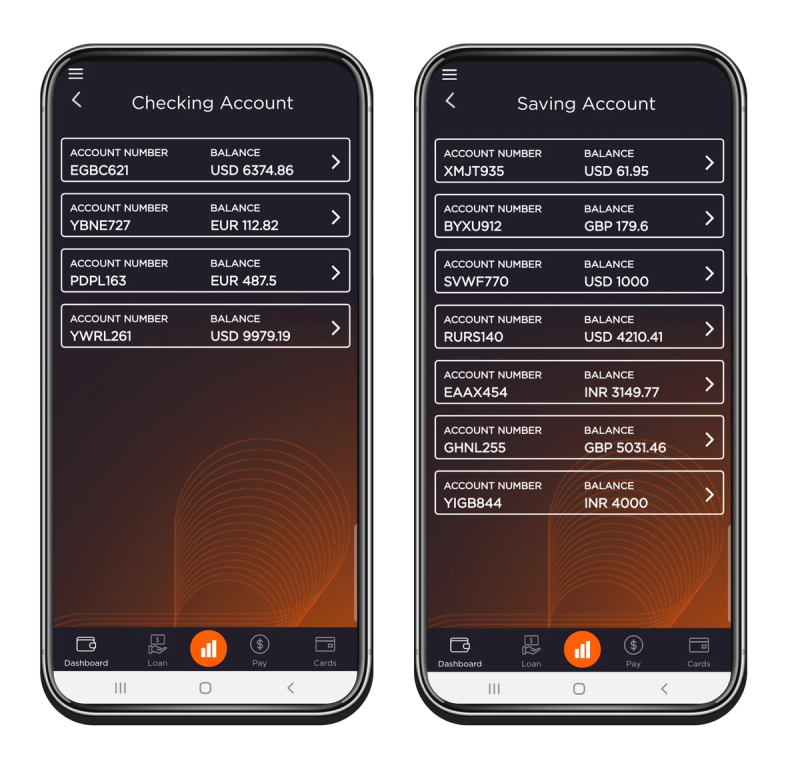

Users can move further into the Checking or Saving Account summaries, to view a list of unique accounts in multiple currencies. This seamless functionality allows for clear visibility of consolidated account totals.

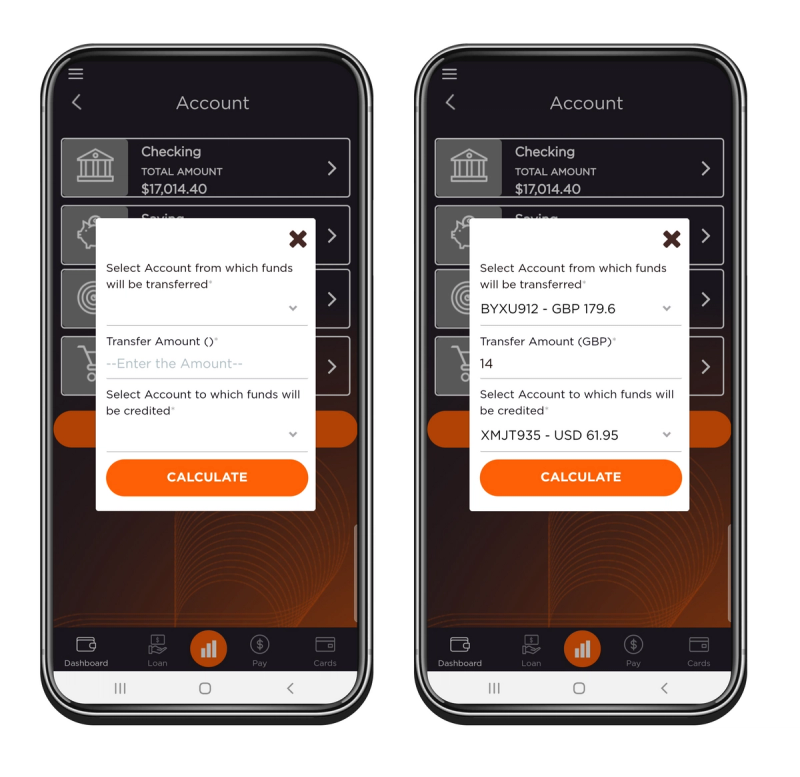

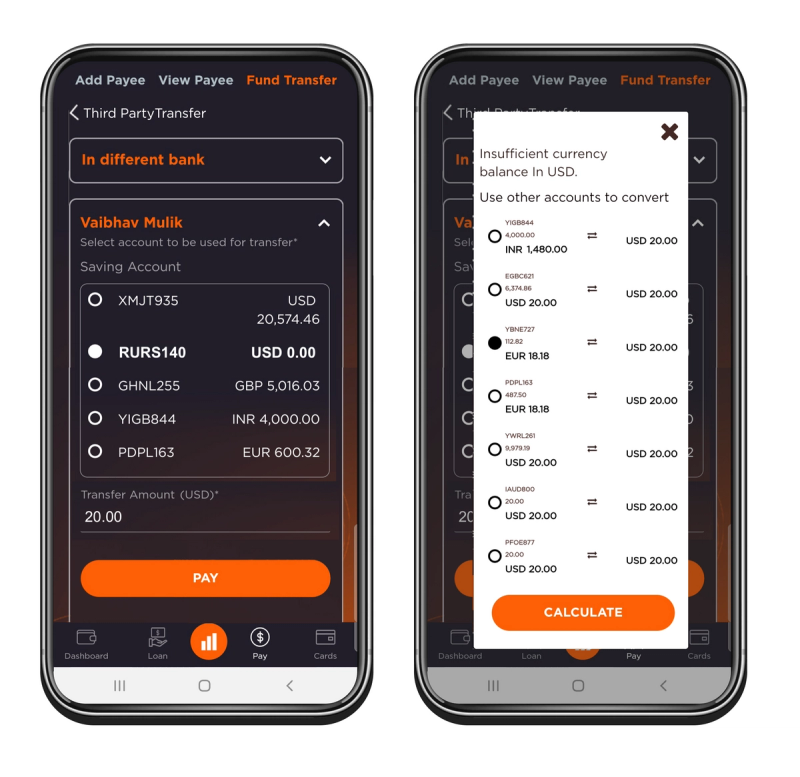

Within the account overview, users find the option to convert a payment. This triggers a popup where the appropriate accounts can be chosen to send and retrieve the payment, along with the amount of the transfer.

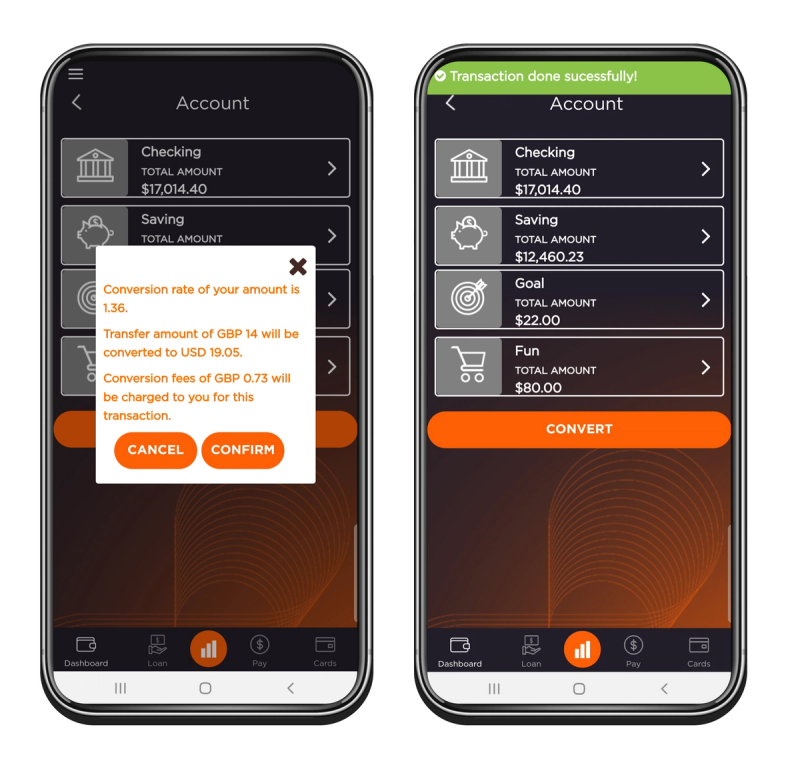

After selecting ‘Calculate’, a new popup appears to display the transaction details including conversion rate, converted transfer amount and fees. The fee amount is always configurable in the Mambu back end. Upon confirmation, the fund transfer will be completed.

Once the funds have been transferred, the debited and credited amounts are visible within the individual accounts, in the correct currency. The account from which the fund transfer originated will also show the fee amount deducted.

When viewing these accounts in the Mambu back end, the credit and debit entries for the same transaction are visible under each account’s ‘Transactions’ tab. This easy and transparent movement of money allows users to transfer payments and funds to various currency accounts, so they can send, receive and spend like a local.

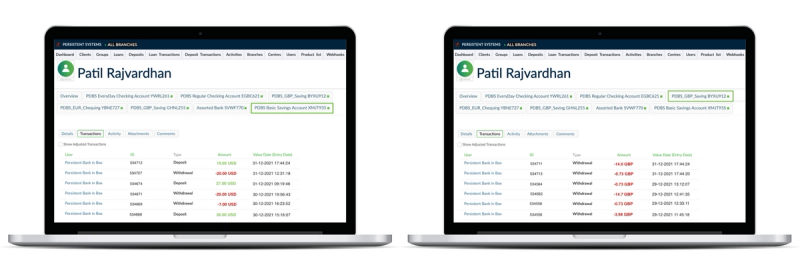

The third functionality to showcase is a transfer to third party accounts from an account with insufficient funds.

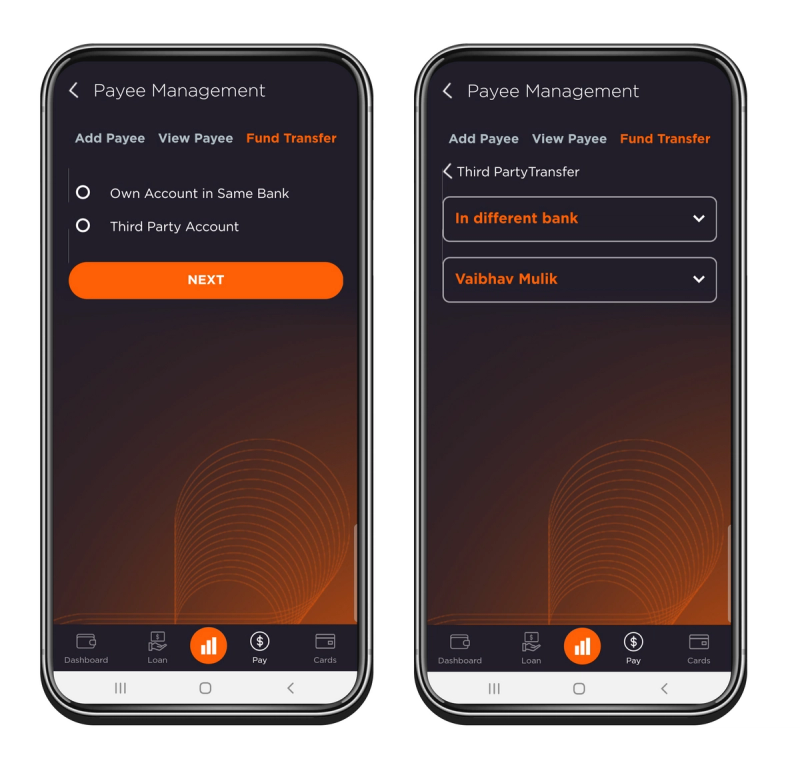

By navigating into the ‘Pay’ tile from the home dashboard, users can select the ‘Fund Transfer’ tab. Here it is possible to select a ‘Third Party Account’ to send a payment to, including previously saved recipients.

The user will select an account from which the transfer will originate, along with the transfer amount. If an account with zero balance is chosen, a popup will appear stating the account has insufficient funds. This display will include a list of accounts that can fund the originating account, in order to supply the funds to complete the transfer.

The user can select an account from this list to fund the transfer. After choosing an account and selecting ‘Calculate’, a popup will appear to display the conversion rate, transfer amount and the conversion fees.

After confirming the transfer, the originating account with a zero balance will be funded by the selected account, allowing the third party transfer to be completed.

With smooth integration and onboarding, users can access the full potential of Multi-Currency accounts leveraging Mambu and Persistent. This puts more control in the hands of the customers, and raises the standard of excellence in banking services.

For more information on how your bank can offer Multi-Currency accounts, get in touch.