Internet and smartphone accessibility has boomed, with approximately 50% of the world’s internet users residing in Asia and the financial industry has not been immune to consumer demand for digital first services. As of July 2022, Europe is home to 77 digital banks and Asia Pacific to 42, while North and South America clock up at 64 and 54 respectively, out of 250 globally. So as digital banking ramps up, establishing a clear definition of success has become evermore critical.

Success in business is often viewed through the lens of profitability, and profitability remains a critical hurdle for digital banks, with data suggesting that only 5% of the total digital banks were profitable as of 2020 - with some seeing profitability take up to five years to come.

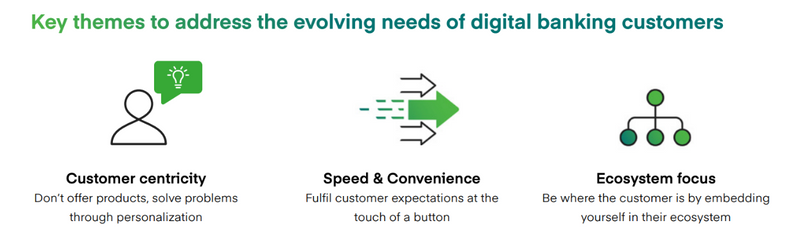

Some key themes have emerged to be paving the way to profitability for digital banks. In the initial phases of operation, tracking metrics associated with the following themes are critical to success: personalisation and customer centricity, increased speed and convenience, and a focus on embedding customers in integrated ecosystems.

N26 and Monzo, for example, thrive on customer centricity, achieving net promoter scores (NPS) that are three to four times the industry average for incumbents. In Asia, digital banks such as TNEX and Bank Jago have built their value propositions around speed and convenience, offering a highly personalised experience to their customers. Finally Universo, a success story in Portugal, has leveraged the Sonae Group retail, telco and technology ecosystem to rapidly capture a customer base and achieve profitability in its fourth year of operations.

With that in mind, a new business model is arising where success is directly proportional to digital capabilities and how successfully digital banks can engage with wider customer segments:

- Reduced reliance on physical infrastructure (branches, premises etc) improves unit economics for digital banks

- The ability to engage and acquire customers provides lifestyle services as opposed to having a product-first mentality

- Reliance on services revenue is then more pronounced compared to traditional credit-based income

- Consistent customer engagement through digital channels enables responsiveness that can lead to better CX

Given profitability is a medium to long term goal for digital banks, how then can a bank know it is on the right track?

- Achieving scale and high valuations to drive investment are initial goals, while minimising acquisition costs

- Closely monitor scale and usage to ensure users are active and not just a statistic for the bank

- Maintaining rev per customer, customer acquisition costs, low burn rate are a key focus initially

- Minimise drop-off and churn

Identifying the right measures of success is critical for digital banks, particularly in the absence of profitability in the first few years of operation. As digital banks look to define relevant success metrics, some questions to ponder are:

- What capabilities will help drive customer acquisition and scale?

- What growth rates and unit economics are feasible based in your market?

- What customer needs will be addressed by product innovation, driving rapid scale?

- What learnings exist from innovations in other markets?

- What KPIs should be measured to ensure you are on track and targets can be met?

- Which partners can support you in maximising performance across these metrics?

Are you transforming your core and looking for advice? Revisit our article What banks should do for successful implementation.