Join Kunal Galav of Mambu and Philipp Baecker of Bain & Company - as we take a deeper dive into how neobanks and fintechs are attracting large amounts of customers with customized, agile banking solutions.

This customer-centric approach is built around combining cloud-native digital platforms with banks’ existing digital capabilities to form what is called “Shared Legacy.”

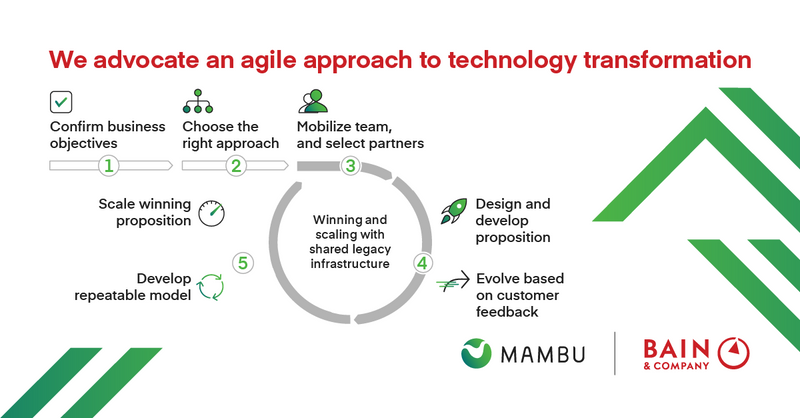

To compete with fintechs, we advocate a process that is firmly anchored in each bank’s unique business context and objectives. While it is by no means a silver bullet to banks’ challenges, an increasing number of innovation leaders have adopted an agile approach to technology transformation that harnesses the power of high-impact micro-battles to rapidly win and scale customer-centric propositions.

By capitalizing on the agility and speed offered by “shared legacy” infrastructure—that is, the original core augmented with new cloud-based platforms—innovation leaders can deliver tangible results more quickly. Using this process, they can codify lessons learned from customer feedback, develop a repeatable model, and launch capabilities to leverage in other parts of the business.