RDC

Partner

Delivering the future of credit, today. Rich Data Co (RDC) empowers lenders to make better credit decisions and achieve superior lending outcomes by combining explainable artificial intelligence with traditional and alternative data sensors.

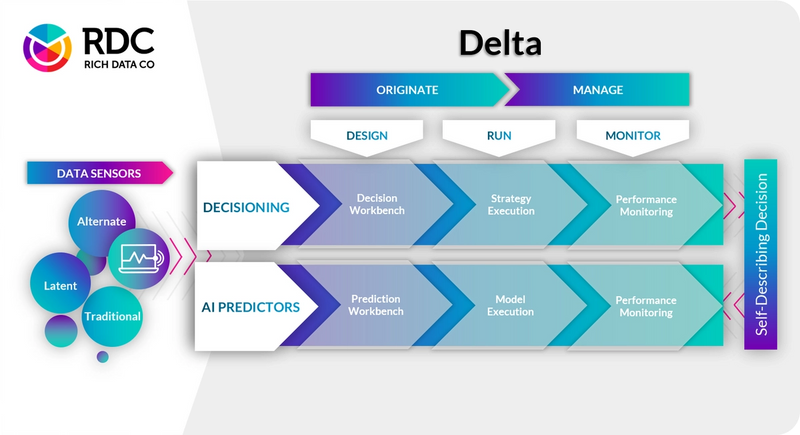

RDC’s unique AI-native credit decisioning solution brings together modelling & decisioning within a single platform, simplifying the traditional credit technology landscape and helping to make management and governance easier. The RDC platform enables lenders to maximize the use of all available data to make accurate predictions & execute intelligent decision strategies.

RDC believes in inclusive, fair, sustainable and dynamic credit for every consumer and SME and is driven by their purpose to increase global access to credit.

Region

APAC, NAM

Connector

Connector not available

Who are we?

Unlock the predictive power of AI Powered Decisioning with RDC. RDC’s platform augments human expert knowledge with AI-native capabilities, providing banks and lenders a competitive edge.

How are we different?

The RDC platform’s unique ‘Glass-box’ approach enables lenders to use AI with confidence. The platform’s design ensures that the use of AI predictive models is accurate, compliant, and transparent and can be executed safely to achieve superior lending outcomes.

The RDC platform’s tooling allows lenders to visualize and understand the logic behind every AI predictive model and decision strategy.

Key Product Features:

The RDC platform is offered as a cloud based, Software as a Service (SaaS) prediction and decisioning platform that can run on RDC or Customer hosted public cloud environments. RDC supports lenders to make good credit decisions in the origination and servicing stages of the lending lifecycle.

The RDC platform is a single SaaS Platform for AI Modelling, Credit Strategy & Decisioning. With capability to leverage traditional, alternative, and latent data, and leverage leading AI techniques lenders can make accurate predictions and achieve optimal decision outcomes.

RDC’s ‘Self-Describing Decisions’ are a first-class data function for a stateful, explainable and reportable credit risk outcome.

- Design, Run, and Manage decision strategies.

- Interpret Self-Describing Decisions with visualisation tooling.

- Understand and optimise rule performance.

- Seamlessly publish changes to your decision strategy.

- Implement ‘stateful’ decision flows, standardising one-to-one relationships between applications and decision outcomes.

Visualization using RDC’s platform enables credit risk users real time insight, modelling and policy authoring capability. Credit Risk are supported to:

- Design, Run, and Manage Predictive Models in a single environment.

- Understand feature performance.

- Manage model performance and governance.

- Accumulate decision logic, enabling AI to learn from experience.

- Streamline reporting within an integrated single environment.

Benefits to Clients:

Delivering benefit to Banks and Lenders, with RDC:

- Achieve profitable portfolio growth with higher approval rates;

- Reduce credit losses with better credit risk assessment;

- Ensure regulatory compliance and ethical decisions with explainable models and decisions;

- Improve operational efficiencies with increased or full automation;

- Improve the customer experience with reduce time to decision, and faster time to yes.

For more information, visit partner website.