In the last 5 years alone, Fintech startups globally have surged to a combined value of $3.5 trillion, up 6.2x since 2016. A reason for this growth is that these firms leveraged the agility of their technology assets to promptly deliver new and innovative solutions to serve evolving consumer demands.

One of the blockers for incumbent financial institutions (FIs) to achieve such agility is their lack of a modern technology stack. According to an IBM study, one in three respondents agreed that underinvestment in core systems has reduced the flexibility needed for digital innovation. Most systems in a tech stack that drive client processes are connected to the Core Banking System (CBS). However, if a CBS is unable to support new, efficient ways of integrating with modern, innovative solutions it can not swiftly deliver on new products, services, and business models.

Our research indicates that, in the life cycle of delivering a new product, integrations can take up to 12 months or more**. Additionally, the complexity and risk associated with integrations can result in failure of delivery and disruption of new business development. Through our learning of 200+ clients, we have identified four integration challenges that FIs face when trying to evolve their technology stack:

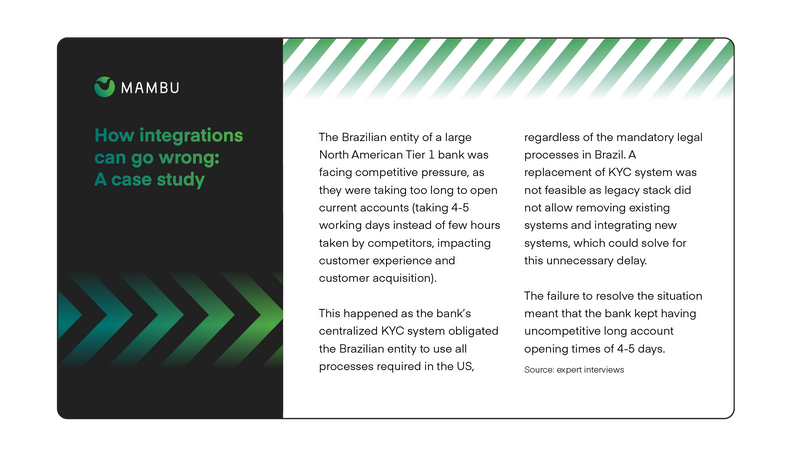

- Legacy stack does not integrate with new systems and vendors

Legacy stack is either incompatible with new systems and vendors, or has bespoke point-to-point integrations. Both make it difficult to integrate with new systems and vendors, which are needed to develop new features and products at pace. - Underperforming systems and vendors cannot be replaced

The legacy stack is often built as a monolith with complex integrations and deep dependencies, making it costly and risky to replace the systems and vendors. This results in having to maintain expensive underperforming systems and also, being charged higher prices by vendors. - Integrations take too long and generate operational risk

So far, new services were added to existing systems as additional layers and with excessive undocumented customizations, resulting in a complex mesh of integrations. Because of this complexity, new integrations take longer and have high risk (outages, downtimes, data loss). - Not building for the future

Sometimes integrations are done ad-hoc, prioritising speed over applying the best practices. This leads to higher costs down the line when integrating additional systems, and leads to IT “spaghetti”, where connections are so many and so unstructured, that risks and costs spiral.

These challenges stem from a monolith approach (build / maintain own systems and using bespoke integrations), versus a composable approach (integrating partner solutions and using standardised loosely-coupled integrations). To enable agility, you need to integrate using a composable approach.

The key benefit of a composable approach is that it allows you to swiftly swap in and out individual components in weeks, not months or years. This enables you to: launch innovative products quickly and frequently, replace underperforming systems and vendors to get latest technology and expertise, and have faster less risky integrations.

Based on our experience with 200+ clients, we learned that following best practices should be a part of a composable approach:

- Pick the right technology stack:

A composable approach requires one to build small independent services (microservices) that communicate over loosely coupled connections (APIs). Hence have a plan to incrementally move to such an architecture. - Have a modern and standardised integration strategy

A standardised integration layer is a software layer between systems to which all new and old systems connect, instead of having bespoke point to point connections. Such a layer enables easy swap in and swap out of systems. - Pick the right partners:

Success of a composable approach depends critically on leveraging partners. Hence choosing the right partners is crucial. Following considerations should be kept in mind:

- Understand what gaps the partner helps fill (e.g. markets access; superior technology etc)

- Prioritise partners and a partner ecosystem who have pre-built integrations

- Get partners who fundamentally believe and share your vision for being agile. - Work iteratively

Have an iterative incremental approach. For instance: FIs with legacy technology stack can begin their transformation by building an additional core, using a composable approach, that is outside their legacy core. Start onboarding new customers to this new core and over time slowly migrate old customers from the old core to the new core. - Plan sunset of your old tech

It is imperative to decommission the old technology stack, which no longer serves a purpose. Else they will continue to hinder you (create complexity, disturbances etc.) and it will become more expensive to maintain over time.

At Mambu we have seen our clients achieve success by using this composable approach:

- Faster time to market for new value propositions : Uala, the Argentine fintech, was able to develop and launch new value propositions for minors and micro merchants – Uala Biz- in less than six months using this approach. Infact, Mambu customers, who are inherently built for composability, typically experience a 60-80% reduction in time to market and launch MVPs in weeks and full digital banks in under six months.

- Better Customer Experience: ABN Amro, a Dutch state owned bank, launched New10 for the SME segment, achieving 60+ NPS scores - well above industry average within the segment. As a matter of fact, the inherent composability enables Mambu customers to outperform peers by +28% and +10% in their end-customer engagement and experience respectively (Source: Mambu analysis).

- Flexibility: TNEX is Vietnam's first digital-only bank and a speedboat by Maritime Bank (MSB), one of the country's leading commercial banks. Adopting a composable architecture enabled TNEX to pick out best-for-purpose tools & services and get the ability to swap out components as required, avoiding vendor lock-in.

The next decade in banking is about agility: those who embrace it will thrive and those that don't will perish.

**Mambu integration expert inputs and Forbes