- Report - Dec 3, 2025

Core banking, born in the cloud

Unleash true change by building the modern banking and financial experiences your customers want and need.

Deliver distinctive CX.

With Mambu at the core of your banking or lending architecture, you gain the agility and scalability needed to build customer-centric experiences that you fully control. Our extensive partner ecosystem connects you to independent services and solutions for the creation of differentiated financial offerings.

Outpace the market.

To stay competitive, you need the true SaaS composable approach only made possible with Mambu. With go lives measured in days and weeks, not years, Mambu's low-code, single code base, public APIs and regular releases have you future-proofed, so you continuously iterate with zero disruption.

Realise new economics.

With services born in the cloud, we help you scale in numbers or across borders. Costs are aligned to growth, opening up new possibilities with no heavy upfront investment, vendor lock-in or expensive professional service engagements. Digital transformation that’s cost-effective.

Mambu by the numbers

- Global Customers

- End users

- API calls per day

- Reduction in carbon footprint vs on-prem

- Countries

- Higher NPS score than other providers

A composable approach

Composable banking started here at Mambu. We founded the company when we realised that legacy and inflexible core banking systems were a barrier to true financial innovation. With Mambu’s composable approach you can combine independent components and services to build exactly what you need, when you need it.

Lending engine

Mambu’s cloud-native lending engine enables banks, fintechs, retailers, corporates and others to build a variety of loan offerings tailored to customer needs. From embedded finance, buy now pay later and mortgages to SME lending and purchase financing.

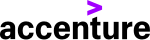

Deposits engine

With Mambu, you get a dynamic deposits engine that can power a wide variety of deposit-based offerings. Build a bank from scratch or take existing offerings digital-first, From banks of all sizes, building societies and credit unions, to digital wallets, prepaid cards and more.

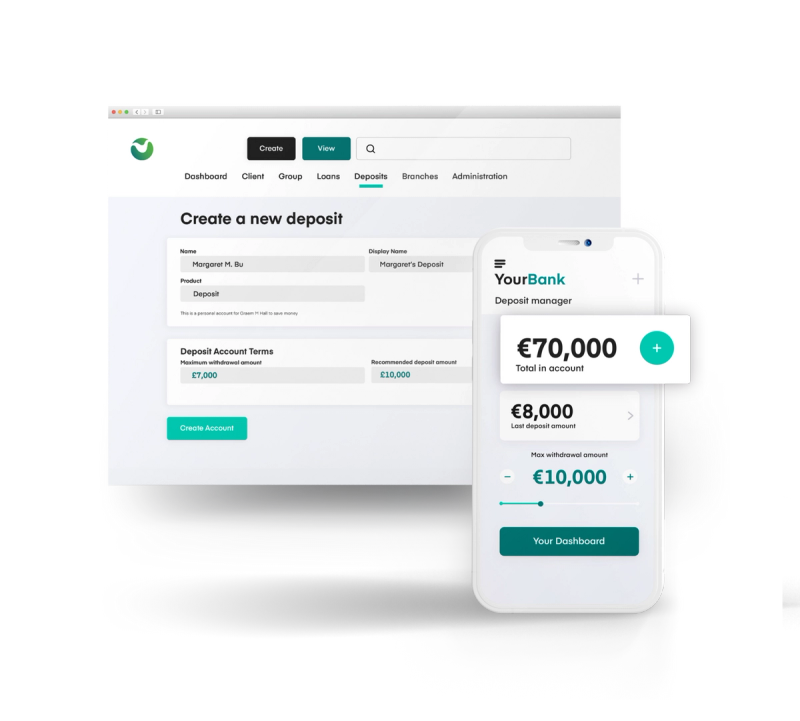

Payments

With Mambu, you get a flexible payments engine that enables seamless money movement with real-time capabilities. Support a wide variety of payment types including domestic, cross-border, instant and batch payments. From banks of all sizes, building societies and credit unions, to fintechs, digital wallets and payment service providers. Integrate with your preferred payment providers and schemes, and tailor workflows to meet regulatory requirements and customer expectations.

“Mambu’s ease of integration, flexibility and time to market has helped us give our customers an unrivalled, technology-driven mobile banking experience.”

“We are very excited to collaborate with Mambu on this project because it aligns with our strategic vision of improving our customer experience and offering our products and services to more Chileans.”

“Running on Mambu not only enables us to focus on scaling and innovation, but it also is a great cultural fit.”

“We have a very pragmatic approach to lending and savings and saw a great match of culture and ethos in Mambu.”

Featured insights

Subscribe to our Mambu newsletter

Get the latest insights and updates straight to your inbox!