Transforming personal lending and nano finance in Thailand

The Good Money app by GSB went live in just 8 months, processing 100,000 loans in its pilot phase acquiring over 10,000 clients with Mambu’s cloud-native platform powering its success.

- months to go-live

- loans processed in the pilot phase

- million under management

GOOD MONEY

About the customer

Good Money by GSB is a digital lending app created by Money DD Co., Ltd., a subsidiary of one of Thailand’s largest financial institutions Government Savings Bank (GSB) serving a third of Thai population.

The platform was designed to offer accessible, affordable, and responsible lending solutions to underserved Thai citizens. With the endorsement of the Bank of Thailand and aligned with GSB’s commitment to providing fair financial products, Good Money is transforming how financial services are delivered to a large portion of Thailand’s population.

Good Money (Money DD) offers Personal Loans and Nano Finance options, with interest rates starting at 19% annually, catering to both personal and small business needs.

The challenge

Breaking the cycle of informal lending

In Thailand, a significant portion of the population relies on high-interest informal lending due to limited access to formal financial services. This creates a cycle of financial instability for many people. MoneyDD recognised the need to provide an alternative solution—one that would offer fair, transparent, and affordable loans to underserved citizens while reducing their dependence on illegal and predatory lending.

To realise their vision, Money DD needed a cloud-native partner to rapidly deploy a solution that could scale with the growing demand for responsible financial services.

The solution

New lending app powered by Mambu and GCP

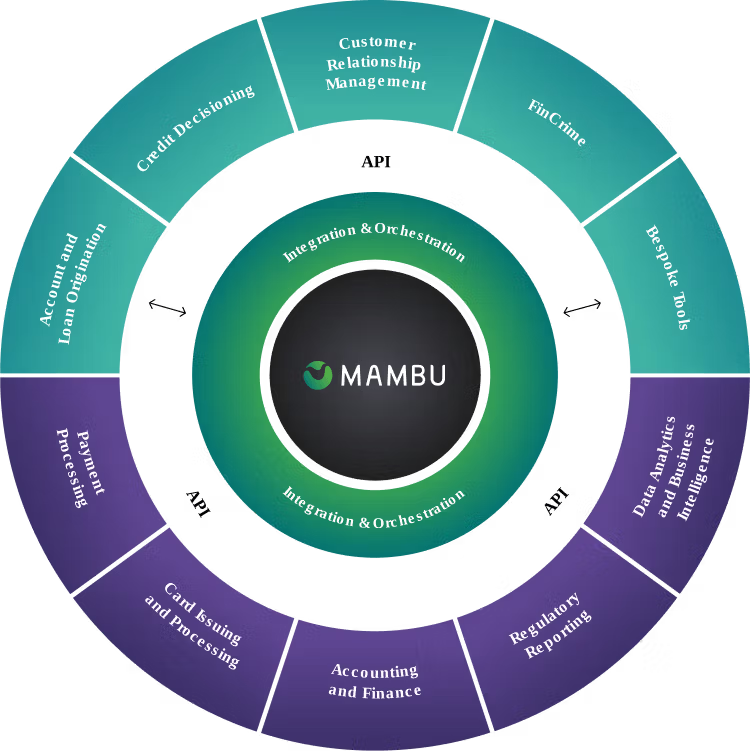

Good Money app was built on Mambu’s cloud-native platform and supported by Google Cloud Platform (GCP), enabling a fast, scalable, and secure lending solution. Mambu’s composable architecture allowed the Money DD team to quickly integrate advanced technologies for assessing borrowers’ financial behavior and adjusting interest rates accordingly, ensuring a fair and transparent lending experience. This solution’s flexibility and speed of deployment were key in meeting GSB’s mission to offer financial inclusion and stability to a large portion of the population.

“Google Cloud’s longstanding partnership with Mambu has enabled it to provide a modern platform that financial institutions are embracing to deliver digital banking products and services that their customers can depend on. Together, we are pleased to be supporting Money DD’s vision of improving financial access for underserved segments across Thailand.”

- Annop Siritikul, Country Director, Thailand, Google Cloud

The result

Rapid success and scalable growth

The Good Money app successfully went live in just 8 months. In its pilot phase, the platform has already processed more than 100,000 loans, acquired 30,000 clients and managed 500 million Thai Baht (13.2M EUR) in loan value. With plans to scale to 500,000 borrowers and increase loan volume tenfold within four years, Good Money is on track to reduce reliance on high-interest informal lending in Thailand.

Powered by Mambu’s flexible cloud-native platform, the app is driving accessible and responsible lending for underserved communities.

“Mambu’s flexible cloud-native solution has been instrumental in realising the vision of Good Money, (Money DD) and helping us go to market with our new proposition in just a few months. Thanks to Mambu’s ability to deliver scalable, customer-centric financial services, we're truly setting a new standard in the development of financial tools, for Thailand’s underserved communities. ”

- Sirinun Jiradilok, Managing Director, Money DD

Ready to transform your lending platform?

Our lending platform is the first cloud-native, SaaS core solution created with scale, agility, ease of use and speed in mind, allowing you to design and launch lending products, at scale.