Article

A composable core for credit unions:

The best defense against chartered fintechs

22 January 2026

For years, credit unions enjoyed the market advantage of being member-owned institutions built on trust. They successfully held off a challenge from fintechs that were disruptive but lacked licenses. That era is over.

With major fintechs securing U.S. banking charters, the competitive landscape is now defined by a fundamental architectural arms race.

The threat isn't just that licensed fintechs can now hold deposits, it's that they operate with an unfair speed advantage rooted in their technology stack. The question isn’t if fintechs will encroach. It’s whether your core system can keep up with competitors that build, launch, and pivot in weeks rather than years.

The real threat: architectural advantage

Credit unions are trusted, member-owned institutions with deep community roots. But trust alone will not offset the friction and lack of agility when members compare their experience side-by-side with a hyper-responsive, digitally native licensed bank.

The deciding factor: Moving beyond the "better core"

Many modernization conversations stop at the interface layer (apps, PFM tools) or focus on finding a slightly better traditional core, like those positioning themselves on "real-time features" or "deep ecosystems."

While those cores are an improvement, they are still fundamentally monolithic. They are essentially faster cars on the same winding road.

To compete with chartered fintechs, credit unions need a core that offers architectural optionality. This is where the concept of a composable core platform becomes the deciding factor.

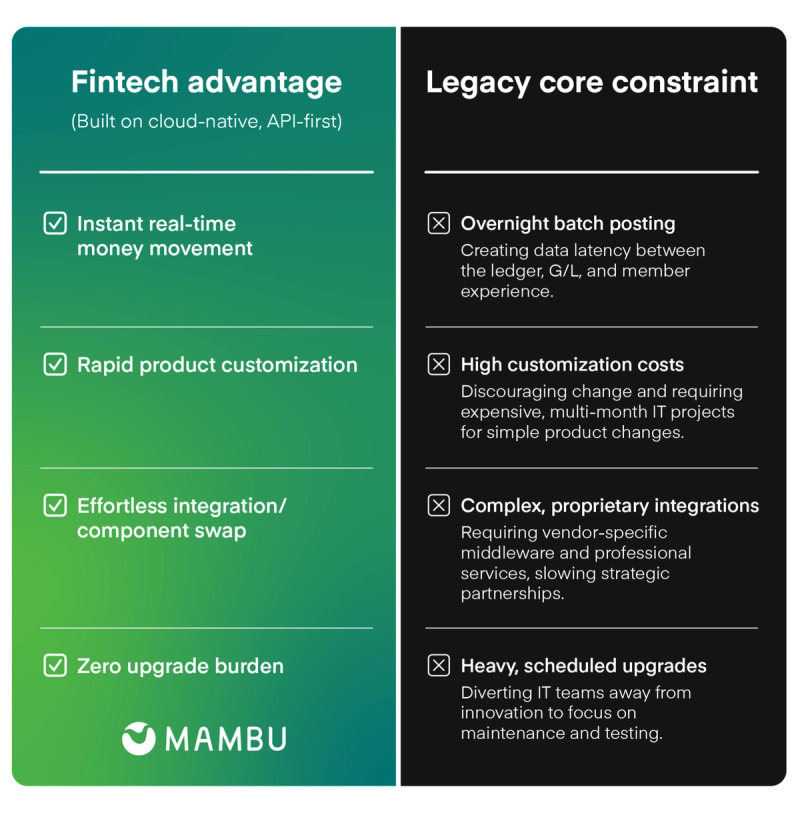

Here are just a few of the advantages of a composable core:

End the integration hostage crisis

Competitor marketing often boasts open architecture. But for the credit union, this often translates to complex, costly, proprietary integrations requiring vendor-certified consultants or developers which are a slow and expensive form of vendor lock-in.

Mambu's approach is true openness. By providing access to all functions via public, simple, standardized, modern APIs, we eliminate the need for heavy middleware. This means your team can integrate best-in-class partners (fintechs, CUSOs, analytics tools) in hours, not weeks, eliminating the high cost of integration consulting.

Achieve true real-time. Everywhere.

Fintechs operate on event-driven principles, meaning all data is instantly synchronized across their ecosystem.

Legacy systems, even the newest ones often confine their real-time processing to the central ledger. Data replication to the General Ledger, the CRM, and the fraud engine can still lag.

Mambu’s architecture is natively event-driven. This means every member action is instantly communicated across your entire connected stack. This isn't just a fast ledger, it's also an ubiquitous real-time data flow. This is essential for instant fraud detection, real-time reporting, and hyper-personalized member offers.

Shift from maintenance to innovation

Competitor systems require significant IT resources for massive, complex upgrades and patches which is a major drain on your innovation budget.

Mambu is delivered as true SaaS. We manage all system maintenance, security, and compliance updates seamlessly. This allows your valuable IT and product teams to stop being software maintainers and refocus 100% of their effort on building differentiating, member-facing products. This shift alone accelerates your innovation cycle to rival any licensed fintech.

Why urgency matters now

What once felt like a distant threat is now a fixed deadline, driven by the entry of licensed fintechs.

Every day a credit union stays on a system built for a batch-processing world, the competitive gap widens. Modernization doesn’t require a risky rip-and-replace. It requires a clear, strategic path focused on composability.

Forward-looking credit union leaders are asking:

- How can we introduce real-time capabilities with minimal risk?

- How can we treat our core as an assembly of services rather than a single, monolithic product?

- How can we free our best talent to focus on member value?

The answer is to implement a strategic composable foundation that allows you to swap in new capabilities, reduce integration friction, and finally compete with the architectural agility of the world's most innovative licensed fintechs.

If you are curious to learn more about our composable architecture and how it can benefit your credit union, contact us here. We’d be happy to help!

We’ve created a practical playbook designed specifically for credit unions embarking on core transformation. It outlines proven approaches for moving from outdated systems to an agile, scalable, cloud-native core.