ARTICLE

Mexico’s financial sector: moving from pilots to production

08 December 2025

Mexico’s financial sector has reached an inflection point. The years of experimentation, policy groundwork and early fintech formation have laid the foundation the market needed for modernisation.

The market is no longer asking “can we do this?” but rather “how quickly, and how safely, can we scale?”

The shift is becoming tangible in the way the sector now moves. The infrastructure has tightened, the rulebook is more explicit and institutions are signaling a strong intention to grow with discipline.

To understand how Mexico compares with global peers, we surveyed more than 300 senior decision makers across Mexico and benchmarked their views against more than 1,500 leaders worldwide.

The results, part of the Mambu Insights Series, offer a cross-topic snapshot of a financial sector entering an era of execution. They reveal what Mexican institutions expect from their suppliers, how they define responsible scale and where they see the strongest opportunities for acceleration.

All of this points to a sector that is firmly on the front foot, stepping into the future with discipline and unmistakable intent.

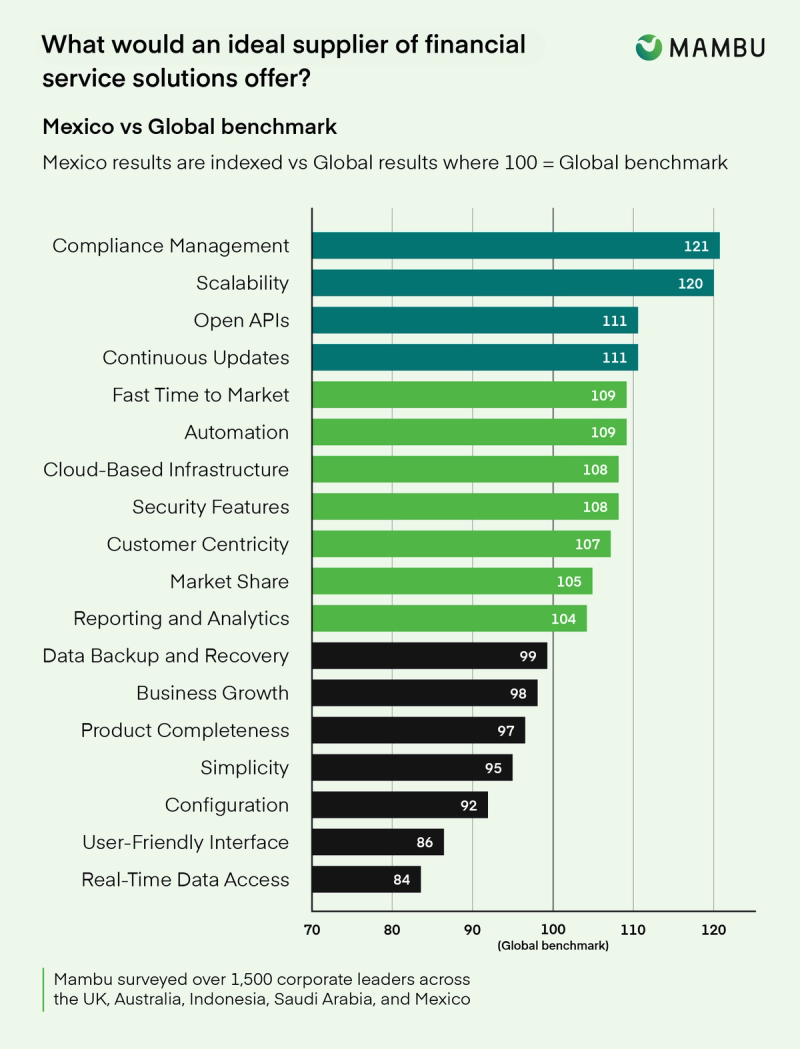

What institutions in Mexico want from their suppliers

Among all markets and regions surveyed, Mexico stands out for one defining pattern: its supplier priorities reflect the country’s regulatory and operational rulebook. SPEI’s always-on and high-control environment has conditioned institutions to value suppliers that can operate with discipline, predictability and resilience. The order in which Mexican leaders ranked supplier traits tells a clear story.

Compliance management

Compliance comes first because, in Mexico, it is the cost of participating safely in the financial system.

SPEI operates in real time and under strict operational safeguards, which means institutions must continually prove that their systems, and the systems of their suppliers, remain aligned with Banxico’s requirements. In this context, compliance becomes a foundational necessity rather than a secondary consideration.

This environment shapes exactly what Mexican leaders look for in a supplier. They want partners who can move in step with regulatory change, adapt cleanly to updates in SPEI’s rulebook and show clear evidence that their technology will not introduce operational or security risk.

In a market where a single lapse can trigger service interruptions or reputational harm, institutions expect suppliers to arrive with compliance maturity already built into the core of their product.

Scalability

Scalability is the second-highest priority, but in Mexico it carries a very specific meaning. Institutions are not simply looking for technology that can handle more customers or a higher volume of transactions. They need platforms that scale their controls, validations and safeguards at the same pace as their activity increases.

As institutions expand through digital channels, API partners and broader product portfolios, the operational workload grows and the cybersecurity surface widens. The system has to hold steady under that pressure.

This reality shapes what institutions expect from their suppliers. Mexican leaders favour platforms that can absorb growth without diluting the protections required by SPEI and the wider regulatory environment. They look for systems that maintain performance during peak demand, preserve the integrity of every rule and check, and continue to enforce controls as volumes rise.

In this context, inadequate scalability is not simply a technical limitation. It becomes a direct compliance and operational risk, something no institution in a real-time ecosystem can afford.

Continuous updates

Continuous updates are a high priority in Mexico reflecting the quick pace of regulatory and ecosystem change in Mexico. SPEI evolves regularly, partner requirements are constantly refreshed and cybersecurity expectations tighten with every new threat.

Mexico’s next phase: execution-led digitisation

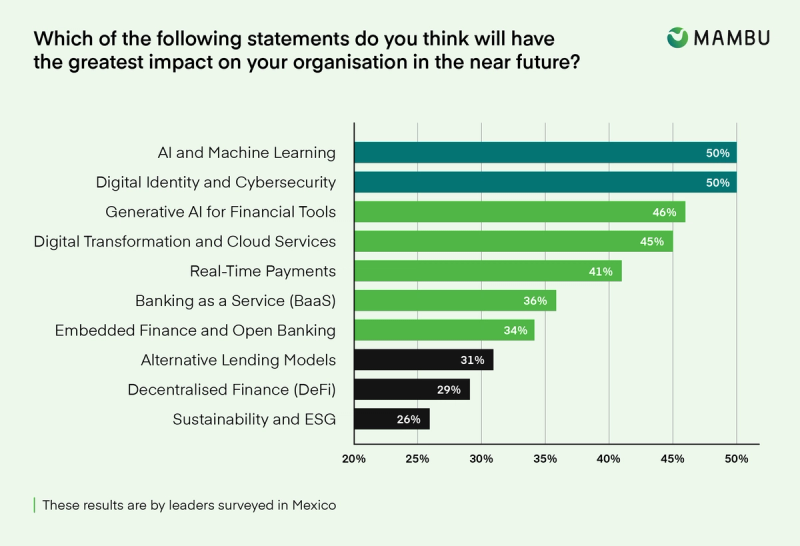

When Mexican financial institutions look ahead, they see a market that will be shaped by their ability to execute digital strategies at scale rather than by continued experimentation. The shift from pilots to production is already underway, and two forces stand out as the strongest drivers of this next chapter: the growing influence of intelligence technologies and an increased focus on cybersecurity.

Intelligence

Artificial intelligence is no longer a peripheral experiment in Mexico’s financial sector. It has started to settle into everyday operations, becoming a practical tool rather than a side project.

Around half of the leaders we surveyed see AI and machine learning as central to determining which organisations will scale successfully, with almost as many highlighting the growing influence of generative AI.

Institutions are already putting these capabilities to work in parts of the business where information moves fast and decisions need to keep up. You can see it in the way fraud teams are sharpening their triage through automated pattern detection, and in how collections teams are prioritising cases with far greater accuracy.

Credit analytics are also evolving, with models learning from broader and richer datasets, while agent assist tools are beginning to support frontline staff with guidance that improves both speed and quality of service. Together, these applications show how AI is shifting from isolated tests to meaningful operational impact.

This momentum comes with a rising level of scrutiny. Global standard setters have noted that supervisors in emerging markets are beginning to watch AI adoption more closely, particularly its operational and security vulnerabilities. As a result, institutions understand that progress cannot rely on enthusiasm alone. Strong governance now sits alongside innovation. Intelligence is becoming a competitive advantage, but it is also becoming a capability that regulators expect to be managed with care.

Cybersecurity

Security is a defining element of Mexico’s digital trajectory. As real-time payments expand and embedded finance and open banking gain traction, institutions understand that each new connection increases their exposure to operational and cyber risks.

Half of the leaders we surveyed identify digital identity and cybersecurity as critical forces in shaping their near-term future, which speaks to a sector that understands exactly what is at stake.

You can see this awareness in the way institutions talk about their responsibilities. Real-time environments offer almost no margin for error, and rising customer expectations mean that trust has to be earned with every interaction.

As digital volumes grow and journeys become more complex, data must stay protected, authentication has to remain consistent across every touchpoint, and transaction flows need to hold their integrity under heavier traffic.

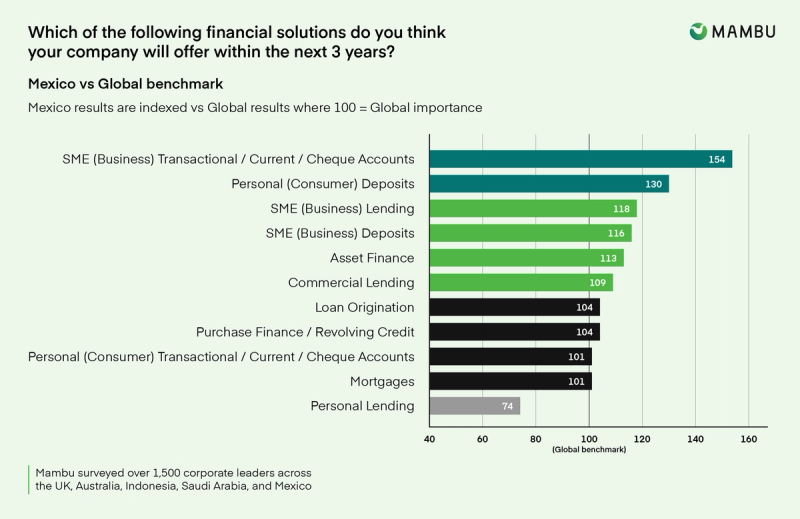

Mexico’s growth strategy: building around SMEs and steady deposits

Looking three years ahead, Mexican financial institutions are preparing for a period of expansion that is rooted in the productive core of the economy rather than in speculative innovation.

The survey responses point to a deliberate move toward the segments that offer long-term stability and meaningful commercial value, particularly small and medium-sized enterprises and the deposits that provide the foundation for future lending.

Institutions are focusing on the parts of the market that create steady demand, real transactions and sustained economic activity.

SME Banking

The strongest signal in the forward portfolio comes from the renewed focus on SMEs. Among all product areas, SME transactional and current accounts are rising in strategic importance.

Mexican leaders repeatedly highlight this segment as central to their growth plans, and the prioritisation reflects a broader acknowledgement that SMEs represent one of the most significant engines of economic value in the country.

This is a deliberate pivot. For years, small and medium-sized businesses have often sat in the middle ground between retail and corporate banking, sometimes under-served and sometimes overly standardised.

Institutions are now positioning themselves to capture this segment more intentionally. They recognise that SMEs bring regular transaction flows, higher potential for cross-sell and long-term relationship value. Strengthening SME banking is therefore not simply a product decision. It is a way to anchor future growth in a segment that touches every part of the economy.

Deposit-led Funding

Alongside the focus on SMEs, institutions are giving far more weight to deposit-led funding. Personal deposits are becoming a priority, and this signals a clear shift in how banks and fintechs want to support future lending.

Instead of relying heavily on short-term or wholesale funding, institutions are looking to build a steadier base of everyday savers whose deposits provide predictable, long-term stability.

A similar pattern appears in the SME segment. Institutions are preparing to attract a larger share of SME deposits in order to capture the day-to-day cash flows of businesses. This segment has often been described as the missing middle of Mexican banking, where the relationship potential has not always matched the level of product innovation. By focusing on deposits, institutions are constructing a stronger funding foundation and creating more opportunities to deepen their presence in this segment.

Taken together, these trends show a market that is preparing for disciplined expansion. The vision is not centred on rapid experimentation but on building strength in the areas that offer the most sustainable and scalable growth.

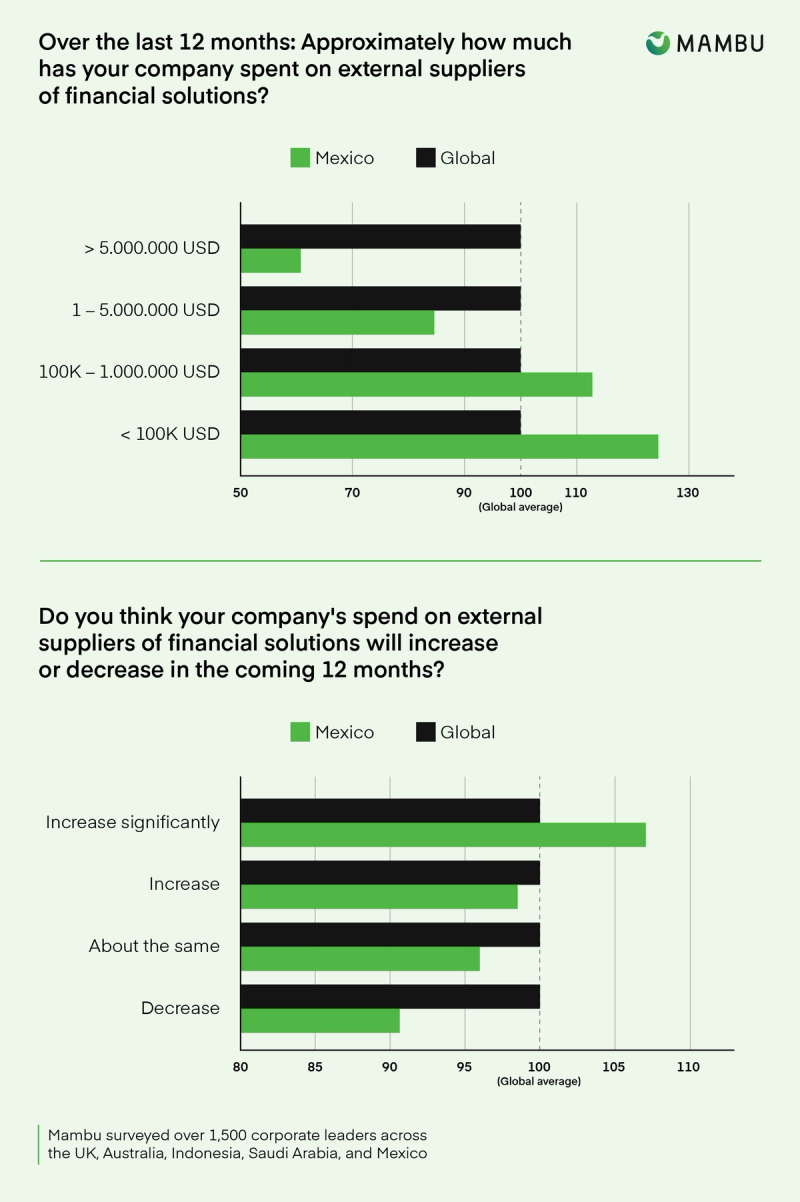

Mexico’s supplier spending is set to increase

Mexican institutions are preparing to increase their spending on external suppliers, but they are doing so from a noticeably leaner starting point than many of their global peers. While other markets have poured significant budgets into external technology over the past few years, many Mexican institutions have kept their spending tight, choosing instead to strengthen internal capabilities before widening their dependence on outside partners. It has been a cautious and deliberate approach, grounded in discipline rather than hesitation.

That groundwork is now setting the stage for a different mood ahead. More than three quarters of Mexican decision makers expect their supplier spending to rise, and a notable share expect it to rise meaningfully.

This shift is not the start of a new technology gamble. It reflects a market that feels it has done the hard internal work and is now ready to bring in specialist partners who can provide the scale and resilience needed for the next phase of growth.

Mexico is moving from selective experimentation to focused investment. Institutions want suppliers who can help them move faster without losing control, adapt without disruption and remain compliant as the regulatory and payments landscape evolves. They are looking for technology that fits into a real-time environment, not hypothetical future architectures.

In other words, Mexico is preparing to invest, but it intends to do so with purpose rather than volume. The market is choosing partners who can turn disciplined internal foundations into scaled external outcomes.

Supplier choice in Mexico: a strategic decision

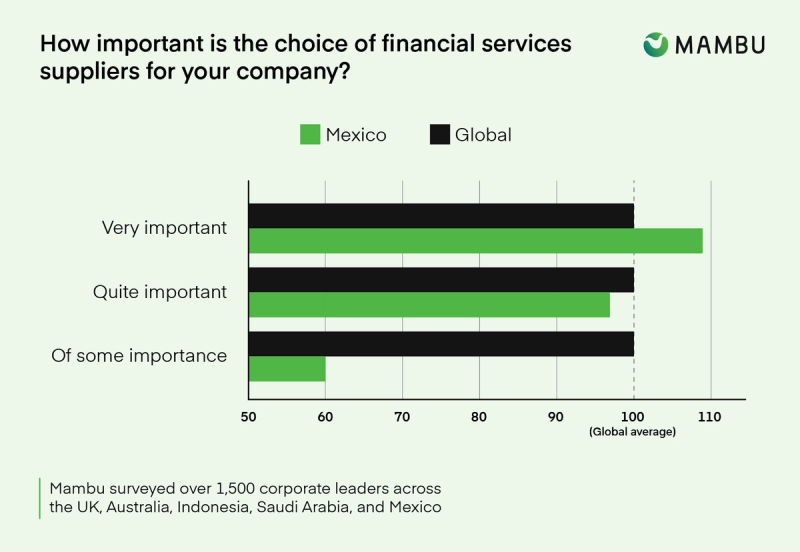

Supplier selection in Mexico has become a strategic decision rather than a routine procurement step.

A larger share of leaders emphasise its importance compared with their global peers, and that emphasis reflects the realities of a market shaped by real-time operations and strict regulatory expectations.

Institutions understand that the suppliers they choose will sit inside the same guardrails they do, which means the wrong choice can compromise compliance, delay product delivery or introduce risks that are difficult to unwind.

As a result, Mexican institutions look for partners who can demonstrate discipline, stability and a proven ability to operate within the country’s regulatory framework. They are not swayed by flashy features or ambitious roadmaps in isolation.

They want suppliers who can integrate cleanly, update reliably and support scale without disrupting service. Trust is earned in production, not in presentations, and institutions are selecting partners who understand the environment they are stepping into.

Supplier choice, in this context, is a decision with long-term consequences, and leaders are treating it with the significance it deserves.

Mexico x Mambu: A perfect partnership for progress

Ultimately, Mexico’s financial sector is looking for much more than simple technology vendors.

Institutions want a partner who understands how real-time systems operate, how regulatory expectations evolve and what it takes to scale in a market where SMEs and deposits are becoming central to long-term sustainable growth. Compliance needs to be part of the product, scalability has to hold under real-world pressure and updates must keep institutions aligned with an ecosystem that changes quickly.

At the same time, suppliers must integrate cleanly and support the kind of product agility that allows banks and fintechs to deepen their SME portfolios and build the steady deposit bases that fund future expansion.

This is the context in which Mambu becomes a perfect fit. Mambu’s cloud-native and composable platform is designed for institutions that want speed, discipline and control all at the same time. It supports environments where rules are non-negotiable and where compliance has to live inside the product rather than on a governance checklist.

Institutions in Mexico need technology that adapts quickly without sacrificing stability, and Mambu’s continuous delivery model ensures that regulatory changes and security enhancements reach customers without disruption.

Scalability is equally important. Mexico’s financial institutions are building portfolios that depend on rising transaction volumes, expanding partner networks and a broader range of digital services.

Mambu’s architecture supports this growth by maintaining performance and controls as activity increases. It is designed to handle higher volumes while keeping the integrity of checks, validations and operational safeguards intact.

The country’s pivot toward SMEs and deposit-led funding also calls for a platform that can launch, refine and expand products quickly.

Mambu allows institutions to configure tailored offerings for SMEs and retail clients across business lending, current accounts and deposit products, respond to market signals in real time, and distribute services through partners and channels without lengthy redevelopment cycles.

For a market that wants to build strength in the productive heart of the economy, this flexibility is essential.

Institutions in Mexico are preparing for a future where execution will define success. They want partners who stand up well under scrutiny and who understand the operational realities of a real-time environment.

Mambu gives institutions the stability and flexibility to scale with confidence, stay aligned as the rulebook evolves and build the next generation of financial products without unnecessary complexity.

Mexico has put the work into their financial sector and built the foundation for an exciting new phase of disciplined, digital growth. The market is ready to move, and Mambu stands ready for the market.

Conclusion

Mexico’s financial sector is approaching a moment where disciplined scale, strong compliance and sharp execution will define competitive advantage. Institutions are looking for partners who can move confidently within the country’s regulatory framework, support growth in SMEs and deposits and deliver technology built for a fast-moving landscape. All that’s required to turn preparation into progress, is the right partner.Curious to learn more about our composable architecture and how it can benefit your institution?

Contact us in the form below for any questions you may have. We are happy to assist.

Alternatively, if you would like to see our platform in action, register for our next live demo.

Transform banking with us.

Ready to build the next generation of financial experiences? Fill out the form to connect with our team.