PARTNER

Trigger Software

Trigger Neobank Engine powered by Mambu allows banks, telcos, and fintech companies to launch their own neobanks or digital wallets in less than six months and at a fixed price.

Region

Global

About the partner

Nowadays, a lot of companies worldwide are planning to launch a digital neobank. These are banks, retailers, telcos, and greenfield fintech startups.

In order to launch a digital bank, you must choose the key components: core banking platform, middleware, front-end, card processing, CRM, back-office, KYC solution, and other parts.

This process takes a lot of time and effort because you need to align with multiple stakeholders. What if there was an end-to-end solution with all the necessary components already pre-integrated?

Trigger Software developed 300+ pixel-perfect screens and 150+ ready-made banking business processes:

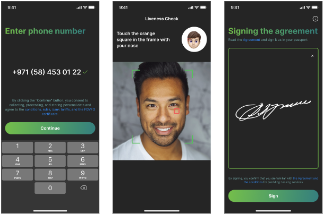

Customers can experience hassle-free onboarding in less than 10 minutes. A new account will be created in Mambu with quick access to a range of digital banking services. All from the mobile device and in accordance with the compliance rules of the bank.

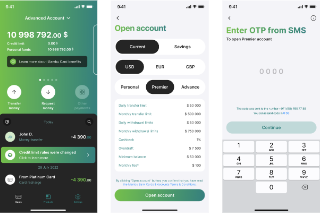

Mambu allows you to easily open a bank account through a mobile app, without the need for physical paperwork or branch visits.

A physical and virtual credit or debit card can be issued in Mambu with a few clicks during the onboarding process. Users are able to start making purchases online and at physical stores immediately.

Also, clients can add cards to Apple Pay and Google Pay wallets to enjoy the benefits of contactless payments.

Mambu allows users to keep track of their financial activities with ease, accessing a comprehensive record of transactions filtered and displayed by categories or dates.

Clients can have full control over their credit and debit cards with the intuitive card management features, easily get account statements, set spending limits, and manage card security.

Also, Mambu allows the setup and change of pin-code, CVV-code, block, and unblock the card at any time.

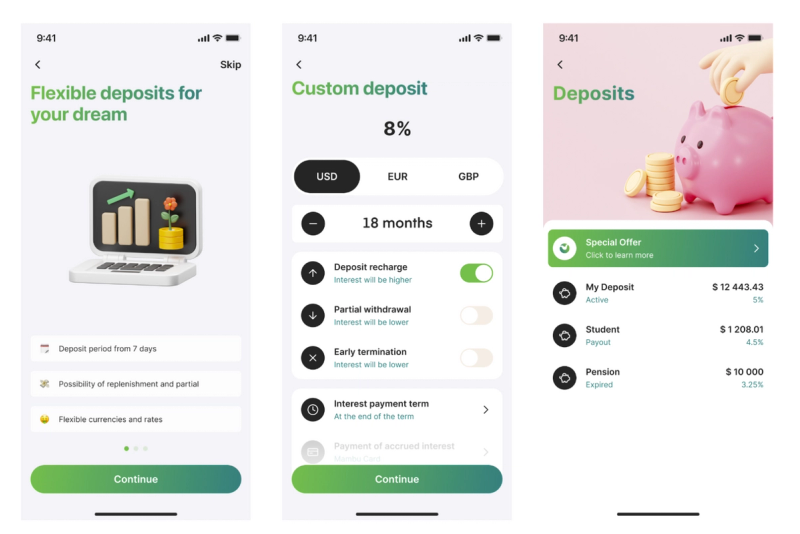

Mambu is a perfect solution to allow clients to deposit funds directly into a digital banking account, ensuring that money is safe and easily accessible.

A deposit account enables users to save money and earn interest on their deposits.

Mambu supports all types of loans with a quick approval process and flexible loan management options.

Installment, cash-to-card, cash-to-account, consumer loans, mortgages, overdrafts, credit limits, and other types of loans are supported.

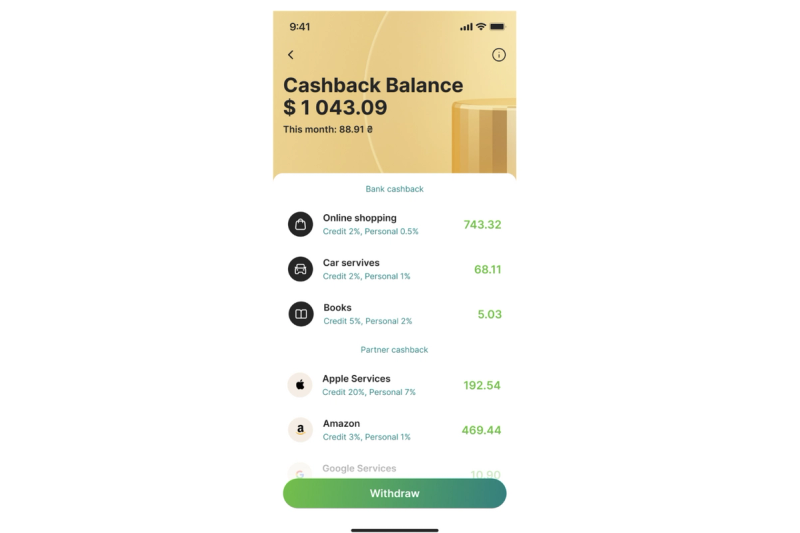

Easily configure rewards rules and allow customers to save money while they spend receiving money or bonuses cashback.

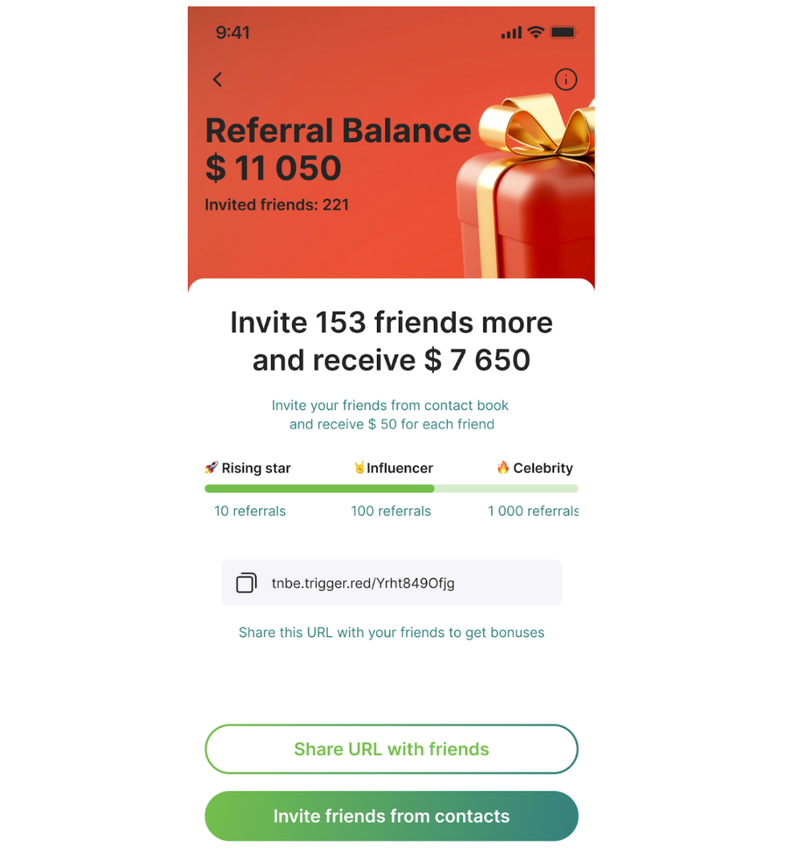

Allow clients to share the benefits of the digital bank with their friends and family, and earn rewards for every successful referral.

Easily configure any products in Mambu. Allow users to discover a wide range of personalized financial products tailored to their current needs.

This includes AI-powered recommendations for financial products and services based on user behavior and preferences, helping clients to make better financial choices.

Configure instant and low-cost domestic and international money transfers making it convenient for users to send and receive funds.

Use accounts and cards configured in Mambu to initiate the necessary transfers.

Stories allow sharing of news, offers, and promotions in a visually appealing and modern design, exactly like millennials enjoy consuming on Instagram.

Convenient and cost-effective currency exchange services for international travellers or users making cross-border transactions.

Activate face recognition and biometric authentication features. Manage language settings and design themes, setup preferred communication channels.

Mambu works perfectly as the single source of truth about the customer profile.

Access to customer support through various channels, such as chatbots, live agents in messengers, or phone support. Flexible integration with any external services.

Robust security measures, including two-factor authentication, biometric login, and real-time transaction alerts, to ensure the safety of user accounts and transactions.

Everything is shipped perfectly pre-configured and packaged into the end-to-end solution running on top of Mambu.

Mambu and Trigger Software

Trigger Neobank Engine fully supports all the benefits of the Mambu API-driven composable architecture.

Interface Constructor allows users to easily configure the interface both for iOS and Android apps. Trigger Neobank Engine renders the JSON into beautiful screens that can be instantly changed without the need to update the app on App Store or Google Play market.

Trigger API Gateway allows building APIs over databases, such as PostgreSQL, MsSQL, MySQL, Oracle, MongoDB and AWS S3 (for files) in less than 1 minute using a simple visual studio.

Trigger also supports integration between Mambu and ChatGPT, which opens new frontiers for the digital banking experience.

Trigger Software’s Neobank Engine powered by Mambu allows easily integration with the necessary components if the customer banks decide to get them from 3rd parties: KYC and identity verification, credit risk and scoring, AML customer screening and monitoring, regulatory reporting, loan collection and recovery, transactions monitoring, data analytics, CRM, etc.

For more information please visit Trigger Software's website.

Ready to innovate and grow with the Mambu ecosystem?