Disrupting German banking: inside C24 Bank's rapid rise

As part of CHECK24, Germany's largest product comparison portal, C24 Bank leveraged Mambu’s flexible platform to scale quickly, deliver exceptional customer experiences, and help customers prioritise smarter financial decisions.

- months to market

- account growth YoY since launch

- highest rated bank in Germany

C24 BANK

About the customer

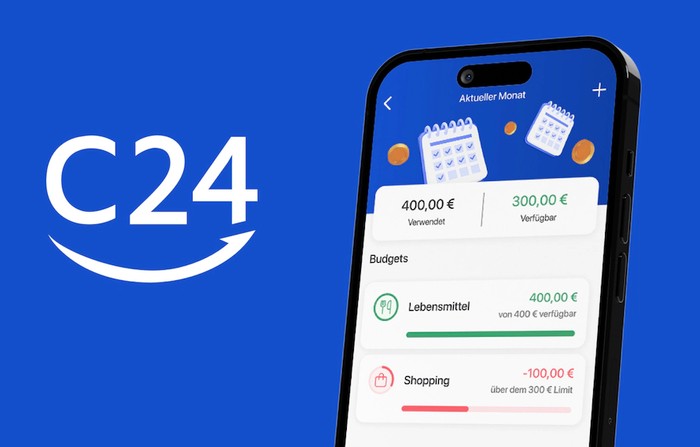

C24 Bank, established in 2019 and part of CHECK24 – Germany’s largest product comparison portal, is a fully regulated and BaFin-approved digital bank focused on customer-centric, transparent banking. With Germany's best checking account, C24 Bank delivers an exceptional user experience, empowering customers to make smarter financial decisions.

The bank provides current accounts, debit cards, loans, and deposit options—all accessible through its fully digital mobile app.

- Launched in 2020

- Germany's best Girokonto

- Goal: serve 1 million customers

The challenge

Navigating competition with customer-first banking

In a competitive, heavily regulated market, C24 Bank sought to differentiate itself by focusing on customer needs, offering low-fee, transparent banking with exceptional customer service. To enter the market successfully, C24 needed to build credibility and trust, meet regulatory requirements and ensure reliability and scalability without compromising speed.

With an ambitious goal of launching within 12 months, C24 Bank required a flexible, composable platform to deliver rapid development and an excellent customer experience.

The solution

Driving rapid and scalable growth with Mambu

C24 Bank selected Mambu as its cloud banking partner for its proven expertise in Germany and the region. Mambu's composable approach enabled seamless integration with C24's ecosystem of partners, including KYC, payments, and cards. Deployed on Amazon Web Services (AWS), C24 Bank opted for a soft, organic launch to ensure system stability and set the stage for future growth. Since then, the bank has expanded its offerings from a single current account product to three tailored account models.

The result

Rapid growth and top-tier recognition

C24 Bank went live in 14 months and has since seen significant growth, driven by its customer-first approach and high satisfaction scores. This growth reflects its ability to innovate and scale quickly. The ongoing partnership with Mambu supports expansion through new products and customer-driven solutions, positioning C24 Bank as one of Germany’s leading digital banks.

- 3x account growth YoY since launch

- 4.8/5 stars: highest rated bank in Germany

- Multiple awards, including best Girokonto and mobile banking app

“The scalability of Mambu’s platform was essential as our customer base grew. Mambu’s flexibility and the breadth of its product offering meant we could introduce new features quickly, like our interest-bearing current accounts, which have been a game-changer in the German market.”

- Thilo Arnold, Managing Director, C24 Bank

Download the full case study

Download the full case study to see how C24 Bank leveraged Mambu’s platform to scale quickly, deliver exceptional customer experiences, and what’s next for their continued innovation.