Worldwide Islamic finance assets are expected to hit $3.69 trillion this year. At the same time, more than two billion Muslim people are underserved due to the limited number of Shariah-compliant solutions. This juxtaposition gives savvy fintechs an entry point to the market, which is primed for transformation and hungry for innovative and flexible financial solutions.

Everyone’s invited

Governed by the requirements of Islamic law, Shariah-compliant banking operates from four key principles – the prohibition of interest, the prohibition of investment in unlawful business, transparency and the sharing of risk and reward, as well as profit and loss sharing contracts. More than 560 banks worldwide adhere to Islamic principles, and the growth of Islamic financial assets is expected to hit $5.9 trillion by 2026.

While an untapped audience of this size is exciting, as is the rapid growth of assets, it’s the rising appeal of Shariah financing with non-Muslims that makes Islamic banking’s potential so significant. Disillusioned by the money-grabbing image of conventional banks and the ongoing pressure of rising interest, people across religions, cultures and geographies are being drawn to the ethical operations of Islamic finance – where they’re welcomed with open arms.

The outcome of an underserved but growing audience, led by a demanding and tech-intelligent, younger generation who are calling for their needs to be met, is a simple one: innovation. And they’re being heard.

Call to action

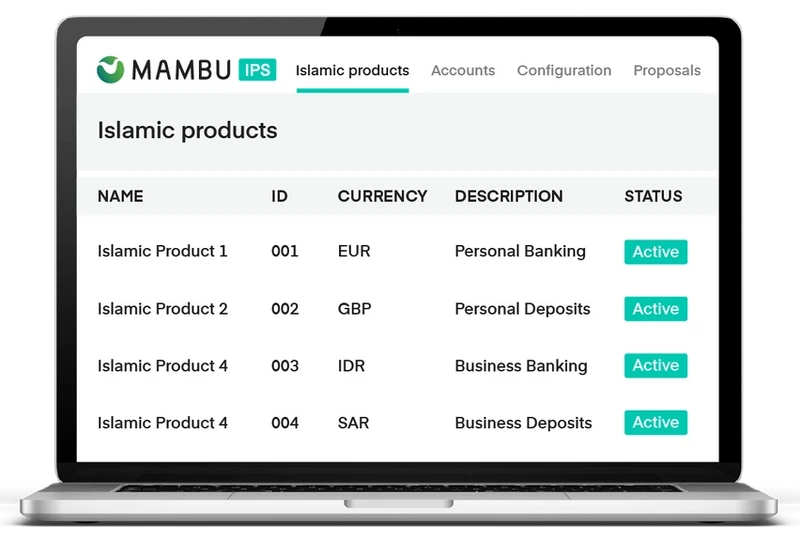

Islamic institutions globally are now actively looking for partners that will help them transform to catch-up with other modern finance bodies and allow them to create modern, Shariah-compliant financial offerings. An example of an exciting response to this brief is in Mambu’s ability to support Shariah-compliant products.

Keeping personalisation, agility and speed at the core of its design, Mambu has already used the cloud to deliver digital Islamic trade financing for SMEs and investors like Ta3meed – enabling the organisation to enhance its offerings, while it grows and maintains brand loyalty by remaining close to ethical codes.

Mambu provides the tech infrastructure that powers Islamic financial institutions - all in the cloud. By developing and launching products on Mambu, Islamic financial institutions gain agility and speed, while providing their customers with products that are aligned with their ethical codes.

Not to mention, through a composable approach, Islamic financial institutions assemble components and services flexibly, while ensuring the delivery of Shariah-compliant products to their customers.

Trends of tomorrow

There’s no limit to the exciting developments within the Islamic finance space today - and the future is just as bright. Only creativity and innovation genius will dictate the changes to come. For banks, fintechs and customers looking for a fresh way to bank, here are a few of the areas that promise to deliver some fascinating opportunities.

- Substantial interest and investment into Islamic fintechs, start-ups and entrenched institutions

- Greater financial inclusion for the underserved and increased financial literacy

- Evolving regulatory frameworks to maintain trust in the Shariah finance sector, whilst offerings and services grow

- Deepened focus on environmental and social sustainability within the sector to align with responsible finance practices