Malaysia’s first Islamic bank takes a digital leap with Be U

Bank Islam Malaysia Berhad (Bank Islam), Malaysia’s largest provider of Shari'ah-compliant financial products and services, has launched an innovative cloud-native digital banking app, Be U, on Mambu’s cloud banking platform.

- weeks to concept

- months to market

BANK ISLAM

About the customer

Established in 1983, Bank Islam is the first Islamic bank, and one of the most well-known and trusted brands in Malaysia providing access to comprehensive Shari'ah-compliant banking and financial services.

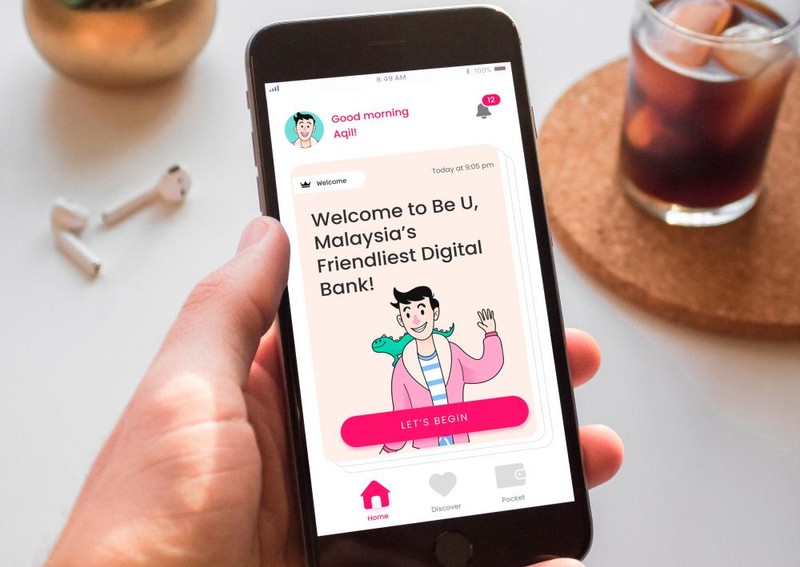

In response to changing customer expectations, in July 2022, Bank Islam launched Be U through The Centre of Digital Experience (CDX), a next-gen, customer-centric fully digital banking app targeted at the digital-native, younger Malaysian consumers.

Marketed as “Malaysia’s Friendliest Digital Bank”, Be U is a ground-breaking digital banking proposition featuring a first-of-its-kind technology stack that is set to become the blueprint for all future digital banks in Malaysia.

The challenge

Balancing digital innovation with core values

Bank Islam, through CDX, recognised the need to embrace digital banking as customer preferences rapidly shifted. The challenge was twofold:

- create a scalable, agile platform that could support rapid innovation and meet customer expectations,

- while also ensuring compliance with Shariah principles.

The goal was to develop a platform that could offer a fully digital experience, enabling Bank Islam to remain competitive in a fast-evolving market while staying true to its core values.

“Mambu’s cost-effective cloud-native banking platform offers the flexibility we need and the ability to collaborate with the broader fintech ecosystem.”

- Noor Farilla Abdullah, Group Chief Digital Officer, Bank Islam

The solution

Shariah-compliant innovation with cloud technology

Mambu’s cloud-native banking platform was selected to power the Be U by Bank Islam app, offering flexibility and scalability required to build and launch innovative, Shari'ah-compliant financial products.

The result

Delivering speed, growth, and customer satisfaction

Building on the success of CDX, Bank Islam launched Be U by Bank Islam app, a fully cloud-native digital banking proposition, in 13 months.

Stay ahead in Islamic Banking

How capable is your tech to handle the coming wave of opportunity in the Islamic banking sector? How ready are you to scale across target markets without legacy constraints?

Download our latest report to gain the insights you need to inform how well-positioned you are.